Time Value and Time Decay

This article addresses the time value of options as well as the effect of time decay.

What is the Time Value of an Option?

The time value of an option is the part of the premium a buyer has to pay in addition to its intrinsic value. The time value is estimated based on the probability that the intrinsic value will increase before the expiry date. It’s the difference between the premium and its intrinsic value.

The Effect of Time Decay

Contrary to its intrinsic value, an option’s time value decreases gradually, until it reaches zero on the expiry date. This effect is called time decay.

Why does the time value decrease over time?

Options are seen as wasting assets. This means that their lifespan is limited.

The probability for an option being “In The Money” is reduced with progressing maturity. The reason is that there’s simply less time left for the investment to become profitable.

Accordingly, there’s a lower chance of selling or exercising the option with a profit. Therefore, the option’s value must be reduced, based on statistical formulas.

Options with shorter time to expiration need to be worth less than options with the same strike price but a later expiry date.

Understanding the key concepts behind time decay is of outstanding importance for successful Fx options trading. Often, the time value makes the difference between a profitable trade and a loss. Therefore, picking contracts with good strike prices and enough time to expiry is a key education for mastering the currency options market.

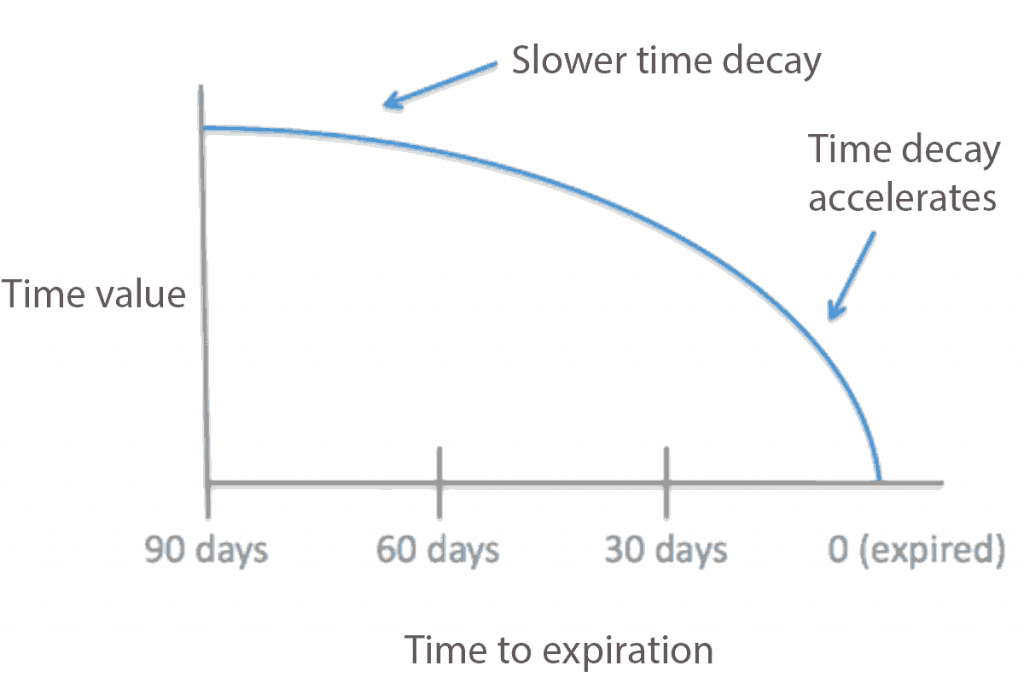

Is the time decay of options linear?

No. Options that are close to expiration experience a much more significant time decay.

We can forecast the outcome much easier when the contract is getting close to its expiry date.

In general, we can observe the following behaviors:

- When an option is Out Of The Money, the loss in time value accelerates in the last two to three months before the expiry. Therefore, it can be wise to roll the contract earlier.

- When an option is deeply In The Money, then the time value decays much faster.

Which parameters influence the time value?

Various characteristics influence the time value. The main parameters are:

- The time until expiration

- The implied volatility

- The price of the underlying asset as well as the strike price

- The interest rates (interest swap rates for Fx options)

The implied volatility measures the expected volatility of an asset during the life of the option.

Calculation of Time Value

Time decay of an option can be quantified. The strength of the time decay is expressed by theta (sometimes abbreviated by the Greek letter Θ). Theta quantifies the premium’s loss in value per day or week if all other settings remain unchanged.

Moreover, there’s the following relationship:

Time Value = Option value – Intrinsic Value

Calculators

Option-Price.com offers a well-known option price calculator for European styles.

The CBOE offers another solid online calculator.

A free Windows program from OTrader Software.

Please note that the time value of options is different to the one of money. The latter one takes into account the value added by the passage of time whereas options contain a time value for quantifying the probability of generating a profit before the expiration.