Options Arbitrage Strategies: Do They Still Work In 2024?

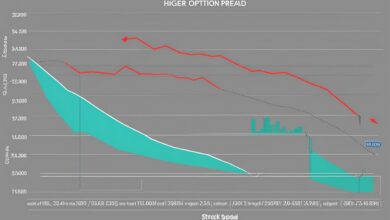

As seasoned traders, we’ve navigated the intricate world of options trading, constantly on the lookout for strategies that can deliver consistent returns. One such approach that has stood the test of time—albeit with evolving complexities—is options arbitrage. Options arbitrage strategies hinge on exploiting the alignment in the pricing of put and call options, an alignment stipulated by the principle of put-call parity. These strategies are designed to identify mispricings that theoretically allow for risk-free options trading opportunities.

The question on our minds is whether these option trading strategies maintain their potency in today’s ultra-competitive markets. The answer isn’t straightforward, as the ubiquity of high-frequency trading platforms and sophisticated algorithms has significantly shortened the lifespan of any price inefficiencies. Nonetheless, our exploration into this domain reveals insights into the current viability of options arbitrage and its role in a modern trader’s repertoire.

Key Takeaways

- Options arbitrage strategies rest upon the foundational concept of put-call parity, helping establish the theoretical fair value between puts and calls.

- Pricing discrepancies between associated options can theoretically yield risk-free trading scenarios under perfect market conditions.

- Today’s market dynamics, impacted by algorithmic trading, present a challenging environment for the individual trader to execute successful options arbitrage.

- Despite the challenges, understanding the mechanics of these option trading strategies can enrich a trader’s skill set.

- Rigorous assessment and quick action are paramount for those looking to venture into risk-free options trading amidst fleeting opportunities.

Understanding Options Arbitrage Strategies

In the realm of options trading, there lie strategies most intricate and nuanced, yet fundamentally potent in their capacity to uncover profit opportunities amid the complex tapestry of market prices. Among these is the arcana of options arbitrage, where the discerning traders that we are seek out imbalances predicted by a prevailing theorem in finance: the put-call parity. At the core of these strategies reside synthetic options strategies, the embodiment of alchemy in modern trading, where we meld together stock positions with call and put options to conjure equivalent positions. These synthetic positions harbor the key to profiting from mispricings without succumbing to the caprices of the market.

By virtue of their design, these strategies tend to manifest typically in two forms. Firstly, the crafting of option spread strategies enables a trader to structure positions that take on a distinctly defensive posture against volatility. Spread strategies encapsulate a variety of approaches, from simple vertical spreads to the more complex iron condors, each with the potential to cap risk while maintaining the pursuit of profit.

On the other hand, the enchantment of option volatility trading tempts those of us who would divine the unseen future levels of market tumult. Options inherently contain a view on impending volatility, and the savvy exploitation of this aspect can yield substantial rewards, should our forecasts prove prophetic.

At our disposal lies the put-call parity, a beacon in the uncertain seas of option prices, assuring us that for every call option there is a corresponding put option with balanced value, given identical strike prices and expirations.

- Synthetic Long Position: Buying a call and selling a put to mimic holding the underlying asset.

- Synthetic Short Position: Buying a put and selling a call to emulate shorting the underlying asset.

- Synthetic Options Spread: Combining options to simulate the payoff of a traditional asset spread.

A finely tuned strategy, however, demands more than an understanding of constructs; it necessitates a mastery of timing and precision, for the windows of opportunity are minuscule and the competition, particularly in the era of automated trading, is relentless.

| Strategy | Description | Risk Profile | Profit Potential |

|---|---|---|---|

| Synthetic Long | A position mirroring the payoff of a stock purchase. | Limited to the net premium. | Unlimited with stock’s upside. |

| Synthetic Short | A position reflecting the payoff of shorting a stock. | Limited to the net premium. | Unlimited with stock’s downside. |

| Vertical Spread | An options spread with differing strike prices but identical expirations. | Capped at the net difference in premiums. | Limited to the spread between strikes minus net premium. |

| Iron Condor | A complex spread betting on low volatility within a particular price range. | Limited to the net premium. | Limited to the received net premium if the asset stays within a range. |

| Volatility Trading | Strategies based on the forecast of future market volatility. | Varies with the selected strategy. | Can be substantial if volatility forecasts are correct. |

We, the scribes and strategists of the financial markets, hereby relay to you, dear traders, that in the church of risk and reward, options arbitrage serves as both shield and sword. It asks of us no small feat: to balance our strikes and expirations on the knife-edge of market timing, turning what can be mere parchment and ink into the folded steel of profit.

Exploring Put-Call Parity in Option Trading

As we delve into the nuances of option trading strategies, a cornerstone of our analysis often includes the concept of put-call parity. This fundamental relationship is pivotal in the pricing of European options and serves as a guidepost for identifying arbitrage opportunities.

Defining Put-Call Parity and Its Importance

Put-call parity articulates a theoretical equilibrium in the pricing of put and call options. Grounded in the premise that options provide a way to construct synthetic positions in the underlying asset, the put-call parity equation ensures that the value of a call option implies a particular fair value for the corresponding put option, with both options having identical strike prices and expiration dates on the same underlying asset. The put-call parity is given by the equation:

C + PV(x) = P + S

Here, the components represent:

- C: the price of the European call option

- PV(x): the present value of the strike price, discounted at the risk-free rate

- P: the price of the European put

- S: the current spot price of the underlying asset

This parity is not just an intriguing mathematical artifact; it is of quintessential importance in maintaining the equilibrium that prevents arbitrage opportunities under regular market conditions. Thus, it allows us to assess whether an option is over or under-valued.

Identifying Arbitrage Opportunities with Put-Call Parity

Any deviation from the put-call parity equation unveils potential arbitrage opportunities for us as traders. These opportunities are predicated on the ability to spot and act upon price inefficiencies between calls and puts. When these divergences occur, we are presented with a brief window to execute trades aimed at securing riskless profits by selling the overpriced asset and buying the underpriced one.

Yet the perfect market scenario, where we could reliably capture these inefficiencies, has become rarer. In today’s technologically advanced and highly efficient markets, such windows close rapidly, often only accessible to those with sophisticated algorithms and the means to execute trades at near-instantaneous speeds. Nevertheless, a thorough understanding of put-call parity remains an invaluable tool in our option trading arsenal, aiding us in developing strategies that navigate and respect these fundamental pricing relationships.

| Scenario | Arbitrage Action | Expected Outcome |

|---|---|---|

| Call Overpriced Relative to Put | Sell Call, Buy Put, Buy Stock | Lock in Riskless Profit |

| Put Overpriced Relative to Call | Buy Call, Sell Put, Sell Stock | Secure Riskless Arbitrage Profit |

| Equilibrium Disturbed by Dividends | Adjust positions based on Put-Call Parity adjusted for dividends | Neutralize Dividend Risk |

| Market Inefficiency Detected | Engage in Conversion or Reversal Arbitrage | Exploit Pricing Discrepancy |

In conclusion, as traders, we continually scour the dynamic landscapes of markets, searching for instances where the delicate balance of put-call parity falters, even momentarily. When identified, these moments not only offer a glimpse into the heart of market pricing mechanisms but also the thrilling possibility of a profitable arbitrage trade. Yet, we remain ever mindful of the fleeting nature of such opportunities and the high level of precision required to capitalize on them.

Assessing the Viability of Arbitrage in Today’s Market

As we ponder the current landscape of options trading, an essential question emerges regarding the practicability of arbitrage strategies within the context of today’s market efficiency. With the evolution of technology in the financial domain, high-frequency algorithmic trading systems have become the avant-garde practitioners of what was once the sacred art of arbitrage. These systems scrutinize market inconsistencies with unyielding precision, exploiting and amending any mispricings far more swiftly than any individual trader could.

The advent of these algorithmic behemoths has imposed considerable constraints on the feasibility and profitability of arbitrage practices for the individual market participant. In the quest for delta neutral options strategies, we confront the reality of an environment where market inefficiencies are as ephemeral as a mirage—appearing tantalizingly real, only to evaporate before the arbitrageur can consummate the trade.

Under such circumstances, we find ourselves examining the essential elements that define market efficiency and arbitrage potential. Risk arbitrages, once a stronghold for potential profit, are now scrutinized under the lens of transaction costs and razor-thin margins. Here, we delve into the quantitative nuances that enshroud our attempts at capturing arbitrage opportunities in the modern era.

Market efficiency is no myth; the rapid rectification of discrepancies attests to a marketplace that is more sentient than ever.

Yet, there is solace in the form of delta neutral options strategies. This sophisticated approach to options trading endeavours to offset directional market risks. By meticulously balancing positive and negative Deltas within a portfolio, we manoeuvre within the narrow alleys that market fluctuations dictate, seeking potential arbitrage opportunities while maintaining a stance of indifference to the whims of market direction.

A prudent approach to arbitrage in the present day demands an incisive assessment of the following factors:

- Availability of actionable discrepancies between options pricing.

- Temporal limitations imposed by the fleeting nature of mispricings.

- Cost-benefit analysis of potential profits in relation to transaction and execution costs.

- The rigorous evaluation of risk exposure and mitigation strategies.

| Arbitrage Factor | Assessment Criteria | Impact on Viability |

|---|---|---|

| Execution Speed | Ability to complete trades rapidly following detection of a mispricing | Crucial; slow execution speed negates opportunities |

| Market Liquidity | Availability of sufficient trading volume to facilitate arbitrage without affecting market prices | Pivotal; illiquid markets hinder effective arbitrage |

| Algorithmic Competition | Prevalence of high-frequency trading algorithms in the market | High; increased competition drastically reduces the scope for individual arbitrageurs |

| Transaction Costs | Commissions, slippage, and other costs associated with executing trades | Significant; excessive costs can render arbitrage unprofitable |

Ultimately, we confront a harsh reality that the traditional vistas for arbitrage have been substantially diminished, if not altogether lost, in the unforgiving environment of today’s financial markets. However, ingenuity and adaptability remain the choice companions for us as traders. Thus, we persist in the exploration of innovative strategies, such as delta neutral configurations, that could potentially leverage the operational mechanisms of market efficiency to our advantage.

Conversion and Reversal Strategies in Options Arbitrage

At the heart of robust options arbitrage strategies lies the creative use of synthetic positions. By astutely crafting these positions, we simulate the payoff of specific stock or options, thereby initiating a disciplined quest for profit within the bounds of market neutrality.

The Role of Synthetic Positions in Arbitrage

Synthetic positions enable us to replicate the economic consequences of a stock position using different options-based configurations. Imagine these positions as dexterous chameleons, altering their appearance to mimic the profile of another financial instrument, but intrinsically, they remain beasts of the same kind—opportunist and adept at survival in the dynamic ecosystem of the markets.

In the context of conversion and reversal strategies, the synthetic approach is employed to capitalize on price discrepancies between calls and puts. It serves as the linchpin for the setup of potentially lucrative options arbitrage strategies.

Executing Conversion and Reversal Arbitrage Techniques

Two principal techniques form the basis of our arbitrage strategies: conversion arbitrage and reversal arbitrage techniques. In conversion arbitrage, we purchase the underlying stock and concurrently sell a call and buy a put. This combination, when perfected, gives us the opportunity to leverage any deviation from fair pricing to realize a risk-adjusted return.

In reversal arbitrage, we take the opposite path. Here, we initiate by shorting the stock, simultaneously selling a put and buying a call. This synthetic position aims to profit from market imperfections, with the call standing ready as a hedge against any potential surge in the stock price, and the put ready to profit should the market decline.

| Strategy | Synthetic Position Constructed | Market Expectation | Profit Mechanism |

|---|---|---|---|

| Conversion Arbitrage | Synthetic Short Position | Neutral to Bearish | Exploit Overpricing of Calls |

| Reversal Arbitrage | Synthetic Long Position | Neutral to Bullish | Exploit Underpricing of Puts |

Our approach to these strategies is akin to navigating by the North Star; conversion and reversal arbitrage offer directional guidance amidst the financial markets’ infinite possibilities. As we execute these strategies, we are ever watchful for alignment with put-call parity, ensuring our maneuvers are well within the threshold of viable arbitrage.

In essence, these arbitrage techniques do not rely solely on predicting market movements. Rather, they are architected to exploit pricing inefficiencies, tethered not to the whims of the market, but to the axioms of pricing models and the undercurrents of supply and demand.

As we continue to refine these arbitrage strategies, we remain steadfast in our commitment to honing a portfolio balanced on the edge of innovation and historical wisdom, ensuring we stay ahead in the relentless pursuit of market inefficiencies.

Delta Neutral Options Strategies for Risk Reduction

In our continuous quest to refine our trading acumen, delta neutral options strategies have proven instrumental in mitigating risks associated with fluctuations in the underlying assets. Familiar to options traders who seek to balance their portfolios against minor price changes, these strategies are a cornerstone of risk reduction in options trading.

Adopting a delta neutral stance involves creating options combinations wherein the total delta — which measures the sensitivity of an option’s price to a $1 move in the underlying asset — approaches zero. Delta itself can be positive or negative, corresponding to long and short positions in the asset respectively. The ultimate goal is to achieve a portfolio immune to the immediate zephyrs of market movement.

Delta neutral strategies harness the delicate balance of long and short positions to forge a bastion of stability amidst the often tempestuous market seas.

Let us explore how delta neutrality operates in practice, aligning positive and negative deltas to safeguard our capital:

- Long calls and short puts increase our delta — rooting for the stock’s rise.

- Conversely, long puts and short calls decrease our delta — bracing for the stock’s fall.

- By equilibrating optimistic and pessimistic deltas, we sculpt a portfolio that neither fears nor favors minor price gyrations.

For the visually inclined, consider the following table, which showcases position deltas and their contribution to a delta neutral strategy:

| Position Type | Delta Impact | Strategy Component |

|---|---|---|

| Long Call | Positive Delta | Assumes stock price will rise |

| Short Call | Negative Delta | Hedges against stock price rise |

| Long Put | Negative Delta | Assumes stock price will fall |

| Short Put | Positive Delta | Hedges against stock price fall |

Dedicated followers of market dynamics know that reaching delta neutrality is not a set-it-and-forget-it deal. As the underlying asset’s price oscillates, adjustments must be made to maintain neutrality. Herein lies the charm and challenge of implementing delta neutral options strategies.

We, as vigilant traders, recognize that while seeking security from volatility, one should not overlook the role of time decay and changes in implied volatility. Thus, achieving delta neutrality is a dance — one that demands our attentiveness to the rhythm of the market’s beat.

In closing this exploration, let us underscore the importance of these strategies in carving a path toward risk-averse options trading. Delta neutral strategies are not about chasing monumental gains; instead, they highlight our commitment to preserving capital and exploiting opportunities borne out of precise, mathematical equipoise.

Impact of Dividend Arbitrage on Option Trading

Within the vibrant world of options trading, dividend arbitrage commands our collective attention. This strategy capitalizes on the inevitable adjustment in option pricing when underlying stocks declare dividends. We’ve witnessed impactful changes on option values correlating with the ex-dividend date—increases in dividends often lead to a concomitant rise in the worth of puts, whilst call values experience depreciation.

Engaging actively in dividend arbitrage, we strive to execute finely-timed strategies that assimilate these shifts into profitable opportunities. The essence here lies in preempting market adjustments to dividend announcements, therein lies the potential for yielding favorable outcomes.

Dividend arbitrage enables traders to harness changes in market dynamics for potential profits, making it a calculated and judicious move in the world of option trading.

Let us elucidate the sequence of our undertaking:

- We closely monitor impending dividend announcements.

- Subsequently, we measure the expected impact of dividend increase on put and call prices.

- Post-haste, we strategize to carry out trades before the equity market fully reflects these new dividends.

Presented hereunder is a table that outlines the potent effect dividends exert on relevant options:

| Action | Impact on Calls | Impact on Puts | Arbitrage Opportunity |

|---|---|---|---|

| Dividend Increase | Value Declines | Value Rises | Buy Puts on Ex-dividend date |

| Dividend Decrease | Value Rises | Value Declines | Buy Calls before Ex-dividend date |

| Stable Dividend | No Significant Change | No Significant Change | Regular Strategies Apply |

Grasping this concept, we as traders, incorporate dividend arbitrage into broader option trading frameworks. It’s imperative to meticulously interpret market data and expertly enact arbitrage operations to actualize potential gains. In these maneuvers, timing is paramount, and our preparedness is our greatest asset.

Bringing together theory and practice, our cannonade in option trading is steadfastly reinforced by the inclusion of dividend-related strategies. Moreover, we are adept in the realization that the impact of dividend arbitrage demands an agile mind and a swift hand, lest the window for action narrows, and the prospect of arbitrage dissipates into the ether.

Merger and Acquisition Arbitrage in Options Markets

In the ever-evolving tapestry of the financial markets, merger and acquisition (M&A) arbitrage has stood out as a beacon for traders looking to capitalize on market events. The essence of M&A arbitrage lies in the artful dance of timing and strategy, where options become the tool of choice to harness the potential windfalls from these corporate maneuvers.

Capitalizing on M&A Announcements with Options

When whispers of mergers and acquisitions begin to ripple through the markets, they bring with them waves of volatility and price adjustments. These market events are fertile ground for options traders proficient in M&A arbitrage to construct positions designed to exploit the ensuing fluctuations. Identifying when to strike requires a blend of keen analysis and an understanding of the nuanced effects of M&A activities on stock prices.

At the heart of M&A arbitrage is the pursuit of asymmetry, where the disparity in information and market reaction presents the prospect of profit.

Our strategy often involves building a position through a careful selection of calls and puts, creating a balanced stance ready to capture gains whether the M&A fruition leads to surges or dives in stock value. We consider variables such as the time frame until the M&A event’s expected completion and the volatility nailed into the options’ premiums.

Success in M&A arbitrage requires navigating a labyrinth of risks and rewards, as speculation can be as whimsical as the rumors fueling them. Our approach entails not only predicting the final outcome but also maneuvering through the market’s sentiment-driven tidal shifts.

Let us consider the layers of complexity that M&A events envelop:

- The anticipation of a merger can inflate call option prices as investors speculate on price jumps.

- Conversely, the fear of a failed merger might elevate put options due to potential price drops.

- Announcement timings, regulatory hurdles, and competitive bids can further skew the expected equilibrium.

| M&A Event Phase | Impact on Call Options | Impact on Put Options | Arbitrage Action |

|---|---|---|---|

| Pre-announcement Speculation | Price Increase | Price Stability or Decrease | Buy Calls on Rumors |

| Announcement to Completion | Volatility based on Confidence | Volatility based on Doubt | Straddle or Strangle Strategies |

| Post-completion Adjustment | Align With Actual Valuation | Align With Actual Valuation | Close or Adjust Positions |

With these strategies, we tread carefully on the tightrope of speculation. Our eyes are set on the prize of capitalizing on market events, aware that in the grand chessboard of M&A, each move determines whether we capture the king of profits or find our queen of capital in jeopardy.

In the end, M&A arbitrage in options markets is a craft that marries the insight of Sherlock Holmes with the risk appetite of a Wall Street maven. As we play this high-stakes game, we relish the chase and the chance to pounce on the right moment, leveraging the churning events of mergers and acquisitions to our advantage.

Pairs Trading Options: A Key Arbitrage Strategy

In the vanguard of arbitrage strategies, pairs trading options stand out as a dynamic approach to profit from relative mispricing between two correlated securities. By engaging in this key arbitrage strategy, we take advantage of a temporary anomaly in the price relationship of a pair of stocks, commodities or indexes that usually move in tandem.

Our methodology is surgical: we initiate a long position in the undervalued asset while simultaneously entering a short position in the overvalued counterpart. Options, with their strategic versatility, act as our instruments, allowing us to capitalize not only on the anticipated price convergence but also providing a cover against systemic market movement.

With pairs trading options, the synergy between risk management and profit opportunities resonates well with our ethos of prudent speculation.

When risk reduction is a priority, the intrinsic hedging characteristics of pairs trading shine, making this one of the most attractive arbitrage options on the trading floor today.

- Identifying pairs: The quest begins by identifying highly correlated assets that have diverged from their historical price ratio.

- Monitoring for divergence: Once a pair is selected, vigilant monitoring is required to strike when a clear spread emerges.

- Options advantage: Utilizing put and call options affords us leverage while containing risk, a hallmark of sound strategic arbitrage.

Let’s illustrate the mechanism of pairs trading with a table that captures the essence of this methodology:

| Step | Objective | Options Action | Arbitrage Aim |

|---|---|---|---|

| Detect Price Divergence | Spot a temporary price discrepancy | Choose appropriate options | Set stage for arbitrage |

| Execute Options Trade | Capitalize on discrepancy | Implement a long-call/short-put or long-put/short-call strategy | Harness price convergence |

| Monitor Correlation | Ensure prices move towards historical norms | Stay poised to adjust options positions | Secure arbitrage profits |

| Close Out Positions | Realize arbitrage gain | Exercise or sell options based on profitability | Finalize arbitrage process |

Our resolve is unwavering: we harness the volatility and convergence in asset prices, all while utilizing pair trading options, a key arbitrage strategy, that hones in on price inefficiencies with the precision of seasoned market strategists.

Box Spread: A Classic Option Arbitrage Example

The box spread, a foundational structure in the realm of classic option arbitrage, is an intricate financial instrument that mirrors the soundness of a risk-free bond if established under ideal conditions. By concurrently buying a bull call spread and a bear put spread, traders attempt to harness inefficiencies in options pricing to achieve a state of profit without the risk typically associated with the markets.

We comprehend the allure of the box spread for its apparent capacity to attain riskless gains—a hallmark of classic arbitrage. Yet, the practice of employing this complex strategy is far from a casual undertaking. It requires profound sagacity to discern those fleeting moments when the market presents an anomaly in the synchronicity of option prices—moments ripe for the box spread’s deployment.

Understanding the box spread demands our acknowledgment of its elegance in theory, yet our approach in applying it remains grounded in the realism of the markets’ demands.

In pursuit of executing a box spread, we are diligent observers of the intricate dance between the four legs that form this strategy. Here lies the crux of the strategy:

- The purchase of an in-the-money call option

- The sale of an out-of-the-money call option

- The purchase of an in-the-money put option

- The sale of an out-of-the-money put option

Our endeavor is to ensure these positions are constructed with congruent expiration dates and strike prices that bind together, forming the sought-after “box” configuration.

And yet, the path to arbitrage profits is strewn with constraints. On the forefront, trading costs loom large—commissions eroding the slim margins of profit, along with the bid-ask spread that often negates the viability of such strategies for the retail trader. Execution speed, too, plays a decisive role; delays but of a moment can spell the difference between seizing an arbitrage opportunity and watching it vanish like a specter in the mist.

Our insights into the box spread are substantiated by the robust methodology of put-call parity—the principle that guides the relationship between call and put options of the same strike price and expiration.

Let us illustrate with a table that delineates potential outcomes of a box spread:

| Position | Strike Price | Cost/Premium Received | Profit/Loss at Expiration |

|---|---|---|---|

| Long Call (In-the-money) | $50 | -$200 | Varies with asset price |

| Short Call (Out-of-the-money) | $60 | +$150 | Max profit if asset < $60 |

| Long Put (In-the-money) | $60 | -$150 | Varies with asset price |

| Short Put (Out-of-the-money) | $50 | +$200 | Max profit if asset > $50 |

| Total Net Premium | Risk-Free Profit (In Theory) | ||

Our navigation through the domain of classic option arbitrage via the box spread is both an academic venture and a real-world challenge. True opportunities for risk-free returns are scantly found, masked amidst market noise, and even more infrequently grasped—vanished before the grasping can turn to holding.

In summary, we regard the box spread not as a panacea for profit but as a potent symbol of arbitrage potential, a guidepost that sharpens our acumen for price disparities hidden within the folds of the options markets.

Adjusting for American Options: Dividends and Interest Rates

As we explore the intricacies of options arbitrage, it is imperative to account for American options adjustments, especially when dealing with dividends and interest rates. These factors can significantly alter the delicate balance of arbitrage strategies, compelling us to constantly adapt to the dynamic landscape of the markets.

The Effect of Dividend Changes on Option Arbitrage

Understanding the dividends effect on arbitrage is fundamental to our strategy. The announcement of a dividend increase can lead to a commensurate increase in put option values. In contrast, the values of call options typically decline to reflect the anticipated drop in the underlying stock’s price following the ex-dividend date. Thus, a savvy arbitrageur must observe and adjust to dividend announcements with precision to maintain profitability in their trades.

Increased dividends can render put options more attractive, while calls may suffer a corresponding decrease in value, presenting unique opportunities for arbitrage strategies.

Our approach involves closely monitoring corporate dividend policies and timings to leverage these changes to our advantage. We are poised to act when dividends announcements are made, ensuring that our strategies are adjusted to align with the new market conditions.

How Interest Rates Influence Options Arbitrage

As much as dividends play a crucial role, so too do the prevailing interest rates influence our options arbitrage adjustment decisions. An uptick in interest rates typically means higher call values and lower put values, stemming from the increased cost of carry for holding positions. It is a nuanced dance of numbers that requires our constant vigilance.

To remain ahead, we ensure our strategies incorporate current interest rates. We diligently calculate the impact of such changes on the pricing of our options, as these fluctuations directly affect the bottom line of our arbitrage prospects.

| Action | Effect on Call Option Value | Effect on Put Option Value |

|---|---|---|

| Dividend Increase | Decrease | Increase |

| Dividend Decrease | Increase | Decrease |

| Interest Rate Increase | Increase | Decrease |

| Interest Rate Decrease | Decrease | Increase |

We recognize that the American options adjustments for dividends and interest rates can pivot a seemingly profitable arbitrage into a humbling experience if not meticulously managed. This is the art and essence of arbitrage strategies that remain at the forefront of options trading in today’s financial theaters.

Arbitrage in the Age of Algorithmic Trading

In our shared journey to outpace the markets, we’ve watched as algorithmic trading has dramatically reshaped the domain of arbitrage, outflanking the more traditional processes at every turn. The decline of manual arbitrage stands as testimony to the new epoch of trade, marked by the rise of machines that conduct transactions with astonishing velocity and precision.

Algorithmic Trading and the Decline of Manual Arbitrage

These sophisticated computational systems have taken the helm in identifying and acting upon arbitrage opportunities that are often as fleeting as they are lucrative. Through intricate algorithms, these systems execute trades in mere milliseconds, capturing profits in intervals short enough to render manual methods nearly obsolete. To put it simply, they’ve recalibrated the scales that balance opportunity against human capacity, prompting a stark decline of manual arbitrage.

Where once traders thrived on foresight and speed, now algorithms dominate, disentangling complex market patterns with robotic discernment.

We find ourselves amidst a period where the “survival of the fastest” encapsulates the essence of successful arbitrage—the proficiency of algorithms to detect differential price movements between multiple markets and swiftly capitalize on them, leaves scant room for the discerning, yet comparatively sluggish, human intervention.

| Aspect of Arbitrage | Influence of Algorithmic Trading | Impact on Manual Methods |

|---|---|---|

| Speed of Execution | Execute orders in fractions of a second | Unable to compete with algorithmic precision |

| Access to Data | Processes vast data sets instantaneously | Relative delay in analysis and action |

| Operational Efficiency | Operates continuously without fatigue | Limited by the bounds of human endurance |

| Arbitrage Opportunities | Captures transient discrepancies swiftly | Opportunities dissolve before manual execution |

The implications for us, who pursue arbitrage in today’s markets, are profound. Where manual strategies demanded meticulous observation and quick reflexes, today’s paradigm requires an alliance with technological might. It is a union of human strategic thinking and the algorithmic execution of trades, a fusion that enables us to contend within the fulminant pace of modern-day arbitrage.

- Adaptive Strategies: Harnessing the power of algorithms to augment our trading blueprints.

- Robust Analysis: Employing machine learning to predict and react to market patterns.

- Continuous Learning: Updating and iterating on algorithmic models in response to market changes.

In grappling with the current trading milieu, we acknowledge that embracing technology is not merely a choice but an imperative for arbitrage. It is a voyage that we undertake with keen cognition of the fact that as the markets evolve, so too must our tools and approaches to remain efficacious in the art of arbitrage.

Conclusion

Throughout our inquiry into the realm of options arbitrage, a poignant truth has emerged: the once fertile landscapes of risk-free returns that beckoned traders of yore have undeniably transformed. In the wake of rapid algorithmic trading, the future of risk-free options trading appears more nebulous than ever. Understanding the craft — the dynamics of synthetic positions, the intricate dance of put-call parity, and the subtle interplay between options and dividends — remains as crucial as it was in the days of simpler markets.

Yet, the reality is unyielding; the options arbitrage strategy effectiveness that thrived in less efficient markets now survives only through the adroitness of sophisticated computational tools and the intrepid spirit of traders. Our age is one where opportunities for arbitrage are ephemeral and the margin for error is perilously thin. We stand on the precipice of a new era, where the sagacious application of strategy, bolstered by technological prowess, dictates the extent of our success.

We resolve to navigate this labyrinth with circumspect acumen, adapting our methodologies to the relentless pace of innovation that defines our time. As we cast our gaze toward the horizon, it is with the recognition that the tapestry of finance continually weaves itself anew. And though the seminal essence of arbitrage endures, its practice is forever changed, challenging us to evolve with the markets we seek to master. This is the future we embrace, the future where the effectiveness of an options arbitrage strategy is bound to the relentless pursuit of market acuity and an unyielding command of cutting-edge trade execution.

FAQ

What are options arbitrage strategies and how do they work?

Options arbitrage strategies involve leveraging inequities in the price of options to execute theoretically risk-free trades. These strategies are typically based on the concept of put-call parity, which suggests a static relationship between the prices of puts and calls. Traders look for discrepancies that diverge from this relationship to create synthetic positions and undertake trades that should result in a risk-free profit, assuming the prices converge to their “correct” values. However, due to high-frequency trading and market efficiency, such opportunities are quickly identified and corrected, making these strategies challenging to execute profitably for the average trader.

What is meant by synthetic options strategies?

Synthetic options strategies refer to the combination of various financial instruments, such as options and stocks, to create a position that mimics another investment vehicle. For example, a trader might combine a stock position with a put or call option to replicate the payoff of a different option. This approach is often used in options arbitrage when a mispricing occurs, allowing traders to construct positions that have the same risk and reward profile as the theoretical option they aim to replicate.

Can you define put-call parity and its significance in option trading?

Put-call parity is a fundamental principle in options pricing that illustrates a specific relationship between the prices of European put and call options with identical strike prices and expiration dates. It ensures that under normal market conditions, there is no opportunity for arbitrage. The significance of this parity in options trading is that it serves as a benchmark to determine if an option is incorrectly priced in relation to its corresponding put or call, thus providing a signal for potential arbitrage opportunities. Traders use the put-call parity equation to identify and exploit these pricing inefficiencies.

What does market efficiency mean for delta neutral options strategies?

Market efficiency implies that all available information is already factored into stock prices, which in turn affects the pricing of options. For delta neutral options strategies, market efficiency means that it becomes harder to find mispricing opportunities to exploit because prices more accurately reflect the true value of the security. Delta neutral strategies aim to create option portfolios that are not affected by small movements in the underlying stock price by balancing positive and negative deltas, but achieving true neutrality and profitability can be more complex in an efficient market where prices are less prone to significant mispricing.

How do conversion and reversal strategies work in options arbitrage?

Conversion arbitrage involves constructing a position by purchasing the underlying stock and simultaneously buying a corresponding put option and selling a call option with the same strike price and expiration. This aims to lock in a risk-free profit if there is a mispricing in the call option relative to the put and the stock. Reversal arbitrage is the opposite; it entails short-selling the stock and simultaneously selling a put option and buying a call option. Both strategies aim to exploit price discrepancies in options and typically involve synthetic positions to achieve a theoretically market-neutral stance.

What opportunities does dividend arbitrage offer in options trading?

Dividend arbitrage in options trading seeks to take advantage of expected changes in option prices as a result of dividend declarations. When a company increases its dividend, the value of put options tends to increase, and the value of call options tends to decrease, reflecting the drop in the stock price on the ex-dividend date. Traders looking to execute dividend arbitrage strategies would take positions in options that capitalize on these movements before the market fully adjusts to the new dividend information, aiming to secure a profit from the resulting pricing inefficiencies.

How can traders benefit from merger and acquisition (M&A) arbitrage using options?

Traders can benefit from M&A arbitrage by using options to speculate on the outcomes of corporate mergers and acquisitions. These events typically cause increased volatility and price changes in the stocks of the companies involved. By constructing option positions that reflect the anticipated movements, traders can potentially profit from the spreads created between the current market price and the expected price post-announcement. Successful M&A arbitrage involves managing inherent risks and requires thorough analysis of the potential deal outcomes.

What is pairs trading with options and how does it function as an arbitrage strategy?

Pairs trading with options is an arbitrage strategy that involves taking opposing positions in two correlated stocks where there is a temporary price discrepancy. For instance, if two stocks usually move in tandem but suddenly diverge in price, a trader might buy options in the underperforming stock and sell options in the overperforming stock, betting that the price gap will close. The use of options allows traders to structure these trades with a limited risk profile while capitalizing on the convergence of the two stock prices, and hedging against broader market movements.

What role do American options play in dividends and interest rates adjustments for arbitrage?

American options differ from European options in that they can be exercised at any time before expiration, which can make them more sensitive to dividends and interest rates. Changes in dividends can alter the optimal time to exercise an option, impacting put and call values differently. Likewise, interest rates can affect the cost of carrying a position, influencing an arbitrageur’s decision-making process. Traders engaging in arbitrage strategies with American options must closely monitor dividends and interest rates to adjust their positions accordingly and maintain profitability in their arbitrage operations.

How has algorithmic trading affected the practice of options arbitrage?

Algorithmic trading has drastically changed the landscape of options arbitrage by introducing systems capable of analyzing market conditions and executing trades in fractions of a second. This rapid execution means that algorithmic traders can identify and exploit arbitrage opportunities faster than manual traders can. As a result, the window for such opportunities has significantly narrowed, making it more difficult for individual traders to participate in traditional manual arbitrage. The prevalent use of algorithms has necessitated the use of similarly sophisticated computational tools and swift execution capabilities for those still looking to engage in arbitrage strategies.