Best Options Trading Strategies

Traders often jump into trading options with little understanding of the options strategies that are available to them. Here, we will discuss the best options trading strategies that every investor should know, including covered calls, married puts, bull call spreads, bear put spreads, and protective collars.

Key Takeaways:

- Options trading strategies are essential for investors to navigate the options market effectively.

- Covered calls, married puts, bull call spreads, bear put spreads, and protective collars are among the best strategies to consider.

- Each strategy has its own risk-reward profile and is suitable for different market conditions.

- Understanding the basics of each strategy is crucial for successful options trading.

- It is important to align your chosen strategy with your investment goals and risk tolerance.

Understanding Covered Calls

One popular options trading strategy that investors can consider is the covered call. This strategy involves buying shares of a stock and simultaneously selling call options on those shares. It is often employed when investors have a neutral to slightly bullish outlook on a stock and want to generate income. By selling the call options, investors collect premiums, which can help offset potential losses or enhance profits if the stock price remains stable or rises.

Covered calls offer an opportunity to generate consistent income through options trading. The strategy allows investors to benefit from the premium received from selling the call options, which can provide a cushion against any potential decline in the stock’s value. Additionally, if the stock price remains below the strike price of the call options, the investor can keep the premium and continue to hold the stock.

However, it’s important to note that when implementing covered calls, there is a possibility of the stock being called away if the price exceeds the strike price at expiration. Therefore, investors must carefully select the strike price and expiration date to align with their investment goals and expectations for the stock’s performance. Furthermore, covered calls are typically used for income generation in a sideways or slightly bullish market, and may not be as effective in highly volatile or bearish market conditions.

Summary:

- Covered calls involve buying shares of a stock and selling call options on those shares.

- Investors collect premiums from selling call options, providing income.

- Covered calls are used when investors have a neutral to slightly bullish outlook on a stock.

- The strategy can help offset potential losses or enhance profits if the stock price remains stable or rises.

- However, there is a risk of the stock being called away if the price exceeds the strike price at expiration.

| Advantages of Covered Calls | Disadvantages of Covered Calls |

|---|---|

|

|

Exploring Married Puts

In the world of options trading, married puts are a popular strategy used by investors to protect against potential downside risk while still allowing for upside potential. This strategy involves owning the underlying stock and purchasing put options. Let’s dive into the details of married puts and how they can be used effectively.

Married puts are commonly employed when investors have a bearish outlook on a stock or want to protect their existing stock positions from potential losses. By buying put options, investors acquire the right to sell the stock at a predetermined price, known as the strike price, until the option’s expiration date. This provides insurance against a significant decrease in the stock’s value.

One of the advantages of married puts is that they allow investors to participate in any potential upside movement in the stock while limiting their downside risk. If the stock price rises, investors can still benefit from the increase, just like owning the stock outright. However, if the stock price declines, the put options act as a form of insurance, providing the right to sell the stock at the strike price, thus limiting the losses.

Example:

Let’s say an investor owns 100 shares of XYZ stock, which is currently trading at $50 per share. Concerned about a potential market downturn, the investor purchases a put option with a strike price of $45 for a premium of $2 per share. This put option gives the investor the right to sell the 100 shares of XYZ stock at $45 per share until the option’s expiration date.

If the stock price drops below $45, the investor can exercise the put option, selling the stock at the higher strike price and limiting their downside risk. If the stock price remains above $45 or increases, the investor can continue to hold the stock, benefiting from any potential gains.

It’s important to note that married puts come with a cost, as investors must pay the premium for purchasing the put options. This premium acts as an insurance cost to protect against potential losses. However, this cost is a small price to pay for the additional downside protection and peace of mind it provides.

In conclusion, married puts can be an effective options trading strategy for investors looking to protect their stock positions from potential downside risk while still allowing for potential gains. By combining stock ownership with the purchase of put options, investors can limit their losses and participate in any potential upside movement in the stock.

Leveraging Bull Call Spreads

When investors have a bullish outlook on a stock but want to limit their upfront cost, one options trading strategy they can consider is the bull call spread. This strategy involves buying call options at a specific strike price and simultaneously selling the same number of call options at a higher strike price. By doing so, investors can capitalize on potential price increases while reducing their overall investment.

The bull call spread allows investors to benefit from a rising stock price above the higher strike price, while also capping their maximum profit. The premium received from selling the higher strike call options helps offset the cost of buying the lower strike call options. This reduces the overall cost of the trade and provides a limited risk-reward profile.

“The bull call spread is an effective strategy for investors who have a bullish outlook on a stock but don’t want to commit a large amount of capital. By leveraging the differential between the two strike prices, investors can potentially generate a positive return even if the stock price doesn’t reach the higher strike price.”

It’s important for investors to carefully select the strike prices and expiration dates for the bull call spread to align with their specific market outlook and risk tolerance. By properly executing this strategy, investors can take advantage of bullish market conditions while managing their risk effectively.

Example of a Bull Call Spread

| Option | Strike Price | Premium |

|---|---|---|

| Buy Call | XYZ Stock $100 | $4.00 |

| Sell Call | XYZ Stock $110 | $2.00 |

In this example, an investor buys a call option on XYZ stock with a strike price of $100 for a premium of $4.00, while simultaneously selling a call option with a strike price of $110 for a premium of $2.00. By doing so, the investor reduces their initial investment by $2.00 ($4.00 – $2.00). If the stock price rises above $110, the investor will profit from the appreciation in the stock price, capped at $10.00 ($110 – $100).

Implementing Bear Put Spreads

When it comes to options trading strategies for a bearish outlook, one popular choice is the bear put spread. This strategy involves buying put options at a specific strike price while simultaneously selling the same number of put options at a lower strike price. The goal is to profit from a decline in the stock price while limiting the upfront cost.

The bear put spread is particularly useful when you anticipate a moderate decline in the stock price. By selling the lower strike put options, you can offset some of the cost of buying the higher strike put options. This not only reduces the overall cost of the trade but also limits the maximum potential loss.

The key advantage of the bear put spread is its risk-reward profile. While the maximum profit is limited to the difference in strike prices minus the net debit paid, the maximum loss is also limited to the net debit. This means that even if the stock price does not decline as expected, your losses are capped.

Example of a Bear Put Spread

Let’s consider an example to illustrate how a bear put spread works. Suppose you have a bearish outlook on Company XYZ, which is currently trading at $50 per share. You decide to implement a bear put spread by buying 1 put option with a strike price of $55 at a cost of $3 per contract and simultaneously selling 1 put option with a strike price of $45 at a premium of $1 per contract.

| Strike Price | Premium | Cost |

|---|---|---|

| $55 | $3 | $200 (=$300 – $100) |

| $45 | $1 |

In this scenario, your total cost to enter the bear put spread is $200 (=$300 – $100). If the stock price of Company XYZ declines below $45 (the lower strike price), the option you sold will expire worthless, and you will keep the premium of $100. However, if the stock price rises above $55 (the higher strike price), both options will expire worthless, and you will lose the entire $200 investment.

By implementing a bear put spread, you can potentially profit from a decline in the stock price while limiting your risk. It is important to carefully analyze the stock’s price movement and select strike prices that align with your bearish outlook to maximize the effectiveness of this strategy.

Securing Profits with Protective Collars

A protective collar is a popular options trading strategy that investors use to protect against potential downside risk while still allowing for some upside potential. It involves buying an out-of-the-money put option and simultaneously writing an out-of-the-money call option on the same underlying asset. This strategy establishes a price range within which the investor is protected, but also limits the potential for further profits if the stock price rises significantly.

By implementing a protective collar, investors can effectively mitigate the risk of a significant decrease in the stock’s value. The out-of-the-money put option provides insurance, allowing investors to sell the stock at a predetermined price, while the out-of-the-money call option helps generate additional income through the premiums collected. This strategy is especially useful in volatile markets or when investors have a neutral to slightly bullish outlook on a stock.

The protective collar strategy is ideal for investors seeking downside protection while still being able to participate in some potential upside movement. It allows for peace of mind during uncertain market conditions and ensures that losses are limited. However, it’s important to carefully consider the specific strike prices and expiration dates when implementing this strategy, as they will determine the extent of the downside protection and the potential for additional profits.

Overall, the protective collar options trading strategy is a valuable tool for investors looking to secure profits and protect against potential downside risk. It offers a balance between protection and potential gains, making it suitable for those with a cautious or conservative approach to trading options. By carefully selecting the strike prices and expiration dates, investors can tailor this strategy to their specific investment objectives and risk tolerance, ensuring that they are well-prepared for any market conditions.

Explaining Long Straddles

The long straddle is an options trading strategy that is often used when there is a high level of volatility in the market. It involves buying both a call option and a put option with the same strike price and expiration date. This strategy is employed when investors anticipate a significant price move in either direction but are unsure of the direction.

By purchasing both the call and put options, investors have the potential to profit if the stock price moves significantly, regardless of whether it moves up or down. This strategy allows for unlimited profit potential as there is no cap on how much the stock price can move. However, it also comes with limited risk as the maximum loss is the premium paid for the options.

The long straddle strategy is often used by experienced traders when they expect a major event or announcement that could significantly impact the stock price. It allows them to take advantage of any large price swings that may occur as a result of the event.

| Pros | Cons |

|---|---|

| – Potential for significant profit regardless of stock price movement | – Requires a high level of volatility to be profitable |

| – Can be used to capitalize on major market events or announcements | – Premiums for both the call and put options can be expensive |

| – Limited risk as the maximum loss is the premium paid for the options | – Time decay can erode the value of the options if the stock price doesn’t move |

“The long straddle strategy allows investors to profit from significant price swings, regardless of whether the stock price moves up or down.”

Conclusion

The long straddle is a popular options trading strategy for investors who anticipate high volatility in the market. It allows for potential profits if the stock price moves significantly, regardless of the direction. However, it also comes with risks, including the need for a high level of volatility and the potential for expensive premiums. It is important for investors to carefully consider their risk tolerance and market outlook before implementing this strategy.

In summary, the long strangle options trading strategy is a versatile approach for investors seeking to capitalize on high volatility. By purchasing both call and put options with different strike prices, investors can potentially profit from large price swings, regardless of the direction. However, it is essential to carefully analyze market conditions and manage risks effectively when implementing this strategy.

Maximizing Returns with Iron Condors

When it comes to options trading, the iron condor strategy is a popular choice for investors looking to maximize returns in range-bound markets. This strategy combines two vertical spreads, a bear call spread and a bull put spread, to create a defined range within which the investor can profit.

The iron condor strategy is best suited for market conditions where the underlying stock is expected to remain within a specific range. By utilizing both call and put options with different strike prices, the investor can establish a range in which they can earn a profit. This range is defined by the strike prices of the options and offers a limited-risk, limited-reward scenario.

To implement an iron condor strategy, the investor would sell an out-of-the-money call option and buy a further out-of-the-money call option with a higher strike price, creating the bear call spread. Simultaneously, the investor would sell an out-of-the-money put option and buy a further out-of-the-money put option with a lower strike price, creating the bull put spread. This combination of options creates the iron condor, with the maximum profit occurring if the stock price remains within the range defined by the strike prices of the options.

Iron Condor Example

| Option | Strike Price | Premium | |

|---|---|---|---|

| 1 | Sell Call | $50 | $2 |

| 2 | Buy Call | $55 | $1 |

| 3 | Sell Put | $45 | $1.50 |

| 4 | Buy Put | $40 | $0.50 |

| Iron Condor Net Credit: $1 | |||

In the example above, the investor would sell a call option with a strike price of $50 and collect a premium of $2. Simultaneously, they would buy a call option with a strike price of $55, paying a premium of $1. On the put side, the investor would sell a put option with a strike price of $45 and collect a premium of $1.50. They would also buy a put option with a strike price of $40, paying a premium of $0.50. The net credit received from the iron condor would be $1.

If the stock price remains between the strike prices of $45 and $50 at expiration, the iron condor would be profitable. However, if the stock price moves beyond either strike price, the investor would start to incur losses. The maximum loss would occur if the stock price moves beyond the strike price of the options, resulting in a loss of the net credit received.

The iron condor strategy offers a potential for consistent returns in range-bound markets, making it a valuable addition to any trader’s arsenal. By properly understanding and implementing this strategy, investors can maximize their returns while managing risk effectively.

Example: Iron Butterfly Strategy

“The iron butterfly strategy is a great way to take advantage of range-bound markets. For example, let’s say the stock ABC is trading at $100, and you expect it to remain between $95 and $105 over the next month. You can implement an iron butterfly strategy by selling a call option with a strike price of $105 and buying a call option with a strike price of $110. At the same time, you would sell a put option with a strike price of $95 and buy a put option with a strike price of $90. This strategy allows you to collect the premiums from selling the options while limiting your risk to the net debit paid.”

It is important to note that while the iron butterfly strategy offers limited risk, it also limits the potential for further profits if the stock price rises or falls significantly. Traders should carefully analyze market conditions and consider their risk tolerance before implementing this strategy. Additionally, it is crucial to monitor the position and make any necessary adjustments as market conditions change.

| Strategy | Profit | Loss |

|---|---|---|

| Iron Butterfly | Potential limited profit within the range defined by the strike prices | Net debit paid |

Spreading Out with Vertical Spreads

When it comes to options trading strategies for limited risk, vertical spreads are a popular choice. This strategy involves buying and selling options with the same expiration date but different strike prices. By doing so, investors can create a spread that allows for potential profits if the stock price stays within a specific price range.

Vertical spreads consist of two options: the long option and the short option. The long option is bought at a lower strike price, while the short option is sold at a higher strike price. This combination allows traders to limit their maximum risk, as the loss is capped at the difference between the strike prices, minus the net debit or plus the net credit.

For example, let’s say an investor believes that a stock will remain relatively stable in the near term. They can implement a vertical spread by buying a call option with a lower strike price and selling a call option with a higher strike price. If the stock price stays within the range defined by the strike prices of the options, the spread can generate a profit.

| Option | Strike Price | Premium |

|---|---|---|

| Buy Call | $50 | $2 |

| Sell Call | $60 | $1 |

In the example above, the investor buys a call option with a strike price of $50 and pays a premium of $2. They simultaneously sell a call option with a strike price of $60 and receive a premium of $1. If the stock price stays between $50 and $60 at expiration, the spread can result in a profit.

Vertical spreads can be used in different market scenarios, including when investors have a neutral outlook on a stock, anticipate limited price movement, or want to hedge against potential losses. By understanding and implementing vertical spreads, traders can take advantage of options trading strategies that offer limited risk and the potential for profits.

Taking Advantage of Time with Calendar Spreads

When it comes to options trading strategies, one approach that investors can consider is the calendar spread. This strategy involves buying and selling options with the same strike price but different expiration dates. By taking advantage of time decay, calendar spreads can offer potential profits if the stock price remains close to the strike price.

Calendar spreads are particularly useful when there is an expectation of limited price movement in the near term. The near-term options decay faster than the longer-term options, which can work in the investor’s favor. This strategy is often employed when the investor believes that the stock price will remain relatively stable over the short term.

It’s important to note that calendar spreads have limited risk, as the maximum loss is capped at the net debit or plus the net credit. However, the potential for profit is also limited. The key to success with calendar spreads lies in selecting the right strike price and expiration dates to maximize the time decay effect.

Example:

Let’s consider an example to illustrate how a calendar spread works. Suppose you are bullish on Company XYZ in the long term but believe that the stock price will remain relatively stable over the next few weeks. You decide to implement a calendar spread by buying a call option on XYZ with a strike price of $50 and an expiration date three months out. At the same time, you sell a call option on XYZ with the same strike price of $50 but with an expiration date one month out.

If the stock price remains close to $50, the near-term option will decay faster, resulting in a decrease in its value. Meanwhile, the longer-term option will have more time value and potentially increase in value. This time decay differential can lead to a profit for the calendar spread strategy.

By utilizing calendar spreads, investors can benefit from time decay and potentially achieve profits in a range-bound market. It is important to carefully analyze the market conditions and select the appropriate strike price and expiration dates to maximize the strategy’s effectiveness.

| Pros | Cons |

|---|---|

| Profit potential from time decay | Limited upside potential |

| Can be used in range-bound markets | Requires careful selection of strike price and expiration dates |

| Defined maximum risk | Profitability relies on accurate market analysis |

Exploring Alternative Strategies

While the previously discussed options trading strategies are widely used and effective, there are also alternative strategies that investors can consider. These alternative strategies provide additional options for managing risk, enhancing returns, and taking advantage of specific market conditions.

Index Puts Options Trading Strategy

The index puts options trading strategy involves using put options on broad market indexes to hedge against potential market declines. By purchasing put options on an index, investors can protect their investment portfolios from market downturns without the need to select individual stocks. This strategy can be particularly useful during periods of market volatility or when there is uncertainty surrounding specific stocks or sectors.

Put Ratio Spread Options Trading Strategy

The put ratio spread options trading strategy is a strategy that combines the purchase of put options with the simultaneous sale of a greater number of put options at a lower strike price. This strategy is typically used when investors have a bearish outlook on a specific stock or index and want to generate additional income while limiting their downside risk. The put ratio spread strategy has the potential for unlimited profit if the stock price decreases significantly, but also carries the risk of potential losses if the stock price remains stable or increases.

Delta Neutral Options Trading Strategy

The delta neutral options trading strategy involves creating a portfolio of options and underlying assets that are designed to have a delta of zero. Delta measures the sensitivity of an option’s price to changes in the price of the underlying asset. By creating a delta neutral portfolio, investors can profit from changes in other factors, such as volatility or time decay, while minimizing their exposure to changes in the underlying asset’s price. This strategy is commonly used by institutional investors and professional traders to take advantage of market inefficiencies.

Call Ratio Spread Options Trading Strategy

The call ratio spread options trading strategy is the opposite of the put ratio spread strategy. It involves the purchase of call options and the simultaneous sale of a greater number of call options at a higher strike price. This strategy is typically used when investors have a bullish outlook on a specific stock or index and want to generate additional income while limiting their upside risk. The call ratio spread strategy has the potential for unlimited profit if the stock price increases significantly, but also carries the risk of potential losses if the stock price remains stable or decreases.

These alternative options trading strategies provide investors with additional tools and techniques to navigate different market conditions and achieve their investment goals. By understanding how each strategy works and its associated risks and rewards, investors can make more informed trading decisions and potentially enhance their overall portfolio performance.

| Strategy | Purpose | Risk/Reward Profile |

|---|---|---|

| Index Puts | Broad market hedging | Potential for limited losses, protection against market declines |

| Put Ratio Spread | Bearish outlook + income generation | Potential for unlimited profit if stock price decreases significantly, risk of losses if stock price remains stable or increases |

| Delta Neutral | Volatility trading | Profit from factors other than changes in underlying asset price, minimize exposure to price movements |

| Call Ratio Spread | Bullish outlook + income generation | Potential for unlimited profit if stock price increases significantly, risk of losses if stock price remains stable or decreases |

Adapting to Market Conditions

When it comes to options trading, adapting to market conditions is crucial for success. Implied volatility, which represents market expectations for future price fluctuations, plays a significant role in determining the profitability of options strategies. Depending on whether the implied volatility is high or low, certain strategies can be more effective than others.

Options trading strategies for high implied volatility:

- Long Straddles: This strategy involves buying both a call option and a put option with the same strike price and expiration date. It can be beneficial when expecting a significant price move in either direction, as high implied volatility increases the likelihood of a substantial price swing.

- Long Strangles: Similar to long straddles, a long strangle involves buying both a call option and a put option. However, the strike prices for the options are different. This strategy is useful in high implied volatility environments when expecting a significant price move but uncertain about the direction.

- Our in-depth guide for high implied volatility strategies can be found here.

Options trading strategies for low implied volatility:

- Covered Calls: This strategy involves selling call options on shares of stock that you already own. It can be advantageous in low implied volatility environments, as the premiums collected from selling the options can supplement potential losses or enhance profits if the stock price remains stable.

- Bull Put Spreads: A bull put spread involves selling put options at a specific strike price and simultaneously buying put options at a lower strike price. This strategy is effective in low implied volatility environments when expecting a bullish or neutral outlook on a stock.

- Another in-dept guide, this time for low volatility markets, can be found here.

By understanding how different options trading strategies perform in varying market conditions, investors can make informed decisions and maximize their chances of success. It’s important to analyze the implied volatility of the underlying asset and select the most suitable strategy accordingly.

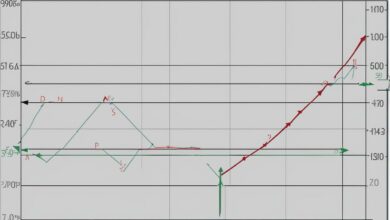

Example of Options Trading Strategies Performance in Different Implied Volatility Environments:

| Options Trading Strategy | High Implied Volatility Environment | Low Implied Volatility Environment |

|---|---|---|

| Long Straddles | Potential for significant profits due to large price swings | Potential for limited profits as price moves may be smaller |

| Long Strangles | Potential for significant profits due to large price swings | Potential for limited profits as price moves may be smaller |

| Covered Calls | Premiums collected can offset potential losses or enhance profits | Premiums collected can supplement potential losses or enhance profits |

| Bull Put Spreads | Potential for limited profits with a bullish or neutral outlook | Potential for limited profits with a bullish or neutral outlook |

Conclusion

Options trading strategies offer a diverse range of opportunities for investors, whether they are beginners or advanced traders. By understanding and implementing these strategies, investors can tailor their approach to their risk tolerance, market outlook, and investment goals.

For beginners, it is important to start with basic strategies such as covered calls and married puts. These strategies provide a solid foundation and allow investors to generate income, manage downside risk, and benefit from bullish or neutral market conditions.

Advanced traders can explore more complex strategies like iron condors and calendar spreads. These strategies provide greater flexibility, allowing investors to maximize returns in range-bound markets or take advantage of time decay. However, it is essential to fully comprehend the risks and rewards associated with these strategies before implementing them.

Regardless of skill level, it is crucial to continuously adapt to market conditions. Different strategies perform better in different environments, so staying informed and adjusting your approach accordingly can lead to more successful trading outcomes. By employing a combination of fundamental and technical analysis, investors can make informed decisions and increase their chances of achieving their investment objectives.

FAQ

What are the best options trading strategies?

The best options trading strategies include covered calls, married puts, bull call spreads, bear put spreads, and protective collars, among others.

What is a covered call?

A covered call is an options trading strategy where investors buy shares of a stock and simultaneously sell call options on those shares to generate income.

What is a married put?

A married put is an options trading strategy where investors combine owning the underlying stock with purchasing put options to protect against potential downside risk.

What is a bull call spread?

A bull call spread is an options trading strategy where investors buy call options at a specific strike price and simultaneously sell the same number of call options at a higher strike price to limit upfront cost while benefiting from potential price increases.

What is a bear put spread?

A bear put spread is an options trading strategy where investors buy put options at a specific strike price and simultaneously sell the same number of put options at a lower strike price to limit upfront cost while benefiting from potential price decreases.

What is a protective collar?

A protective collar is an options trading strategy where investors buy an out-of-the-money put option and simultaneously write an out-of-the-money call option on the same underlying asset to protect against potential downside risk while still allowing for some upside potential.

What is a long straddle?

A long straddle is an options trading strategy where investors buy both a call option and a put option with the same strike price and expiration date to profit from a significant price move in either direction.

What is a long strangle?

A long strangle is an options trading strategy where investors buy both a call option and a put option with different strike prices but the same expiration date to profit from a significant price move in either direction.

What is an iron condor?

An iron condor is an options trading strategy where investors combine a bear call spread and a bull put spread to benefit from the underlying stock remaining in a specific range during the options’ expiration.

What is an iron butterfly?

An iron butterfly is an options trading strategy where investors combine a bear call spread and a bull put spread with the same strike prices to benefit from the underlying stock remaining in a specific range during the options’ expiration.

What is a vertical spread?

A vertical spread is an options trading strategy where investors buy and sell options with the same expiration date but different strike prices to limit risk and allow for potential profits within a specific price range.

What is a calendar spread?

A calendar spread is an options trading strategy where investors buy and sell options with the same strike price but different expiration dates to take advantage of time decay.

What are some alternative options trading strategies?

Alternative options trading strategies include using index puts for broad market hedging, utilizing put ratio spreads for leverage, implementing delta neutral strategies for volatility management, and employing call ratio spreads for income generation.

How do market conditions impact options trading strategies?

Market conditions, specifically implied volatility, can greatly impact the performance of options trading strategies. Some strategies are more effective in high implied volatility environments, while others benefit from low implied volatility.

What are some key considerations when using options trading strategies?

It is important to understand the risks and rewards associated with each options trading strategy and choose the one that aligns best with your investment objectives and market outlook.