Black Scholes Model: The Model That Revolutionized Options Trading

The cornerstone of modern finance, the Black Scholes Model, revolutionized the way we comprehend financial derivatives pricing. Birthed from the academic prowess of Fischer Black, Robert Merton, and Myron Scholes in 1973, this options pricing model is a beacon of mathematical rigor, providing the foundations upon which myriad derivative pricing mechanisms are built. Its implications on financial modeling stretch far beyond the theoretical, granting practitioners a robust analytical tool to navigate the intricacies of options trading with finesse.

Integral to this pioneering model is its aptitude to gauge theoretical values of options with consideration to a multitude of parameters. It serves as an essential algorithm within an options calculator, an indispensable asset for financial professionals who seek to estimate the potential yields and associated risks of derivatives within the engrossing terrain of modern finance. The Black Scholes Model stands as a testament to computational ingenuity, cementing its status as an indispensable tool in the arsenal of financial derivatives pricing.

Key Takeaways

- The Black Scholes Model is a pivotal financial tool for estimating the value of European options contracts.

- Its utilization spans an array of financial derivatives and serves as a cornerstone in contemporary finance.

- Through a mathematical lens, it approaches derivative pricing with a formula reliant on market variables and risks.

- Fundamental to option trading strategies, the model aids in projecting risks and financial outcomes.

- Its development has been seminal in the evolution of financial modeling, particularly in options pricing.

- Modern finance relies substantially on the model for accurate valuation and risk assessment in options markets.

Understanding the Fundamentals of the Black Scholes Model

The Black Scholes Model, conceived in the vibrant landscape of quantitative finance, has earned its eminence by revolutionizing derivative pricing history. This mathematical model continues to serve as an analytical cornerstone for options pricing theory to this day. It epitomizes a synergy between theoretical acumen and practical application, enabling strategists to navigate the complexities of the stock market analysis with unprecedented precision.

Origins and Historical Significance

First introduced in the seminal paper “The Pricing of Options and Corporate Liabilities” in the Journal of Political Economy, the Black Scholes Model history traces its roots back to 1973. Black and Scholes, later joined by Merton, who published a breakthrough article in the Bell Journal of Economics and Management Science, forged a path in financial derivatives research. Merton’s contributions notably advanced the Black Scholes equation, crystallizing a new frontier in derivative pricing history.

The groundbreaking work of these pioneers was more than an academic achievement; it was the inception of a pragmatic tool inscribed within the annals of financial derivatives. The model is reflective of the collective genius of Fischer Black, Robert Merton, and Myron Scholes, whose intellectual synergy catalyzed a paradigm shift in financial valuation and risk management.

For their trailblazing work in establishing a new method to value derivatives, Scholes and Merton were conferred the Nobel Memorial Prize in Economic Sciences in 1997, posthumously crediting Black for his indelible influence on this achievement.

Why the Black Scholes Model Matters in Finance

In the realm of quantitative finance, the relevance of the Black Scholes Model is manifold. It underpins the financial derivatives space by providing a robust framework for estimating the fair value of European style options. As a cornerstone of modern risk management strategies, this model facilitates a comprehensive assessment of potential rewards versus risks, thereby reinforcing market stability and predictability.

- Strategic Relevance: Helps in accurately pricing options, which is integral to the strategies employed by traders and investors globally.

- Risk Management: Aids in the identification and quantification of risks within the financial markets.

- Market Efficiency: Assists in streamlining financial transactions and fostering transparency across trading platforms.

- Academic Pedigree: Continues to be an area of extensive academic research, enriching the literature on options theory and practice.

Its ubiquity across various financial derivatives markets bears testimony to its utility in properly gauging the theoretical worth of options. This is evidenced by its indispensable role in options pricing theory, providing insights that are critical for informed decision-making in today’s fast-paced financial arenas.

Table 1 encapsulates the impact of the Black Scholes Model against various domains within finance:

| Domain | Impact of Black Scholes Model |

|---|---|

| Academic Research | A catalyst for ongoing research and refinement in financial modeling. |

| Options Trading | A logical foundation for derivative pricing, aiding traders in making evidence-based decisions. |

| Risk Management | Enables a quantitative understanding of market risks and the mitigation strategies involved. |

| Quantitative Analysis | A historical benchmark for valuation models used in quantitative finance. |

To appreciate the Black-Scholes Model is to recognize its profound influence on the advancement of quantitative finance and stock market analysis. It remains a definitive model, shaping our current understanding and utilization of financial derivatives.

Demystifying the Black Scholes Formula

The Black Scholes formula is an iconic component of financial theory, offering a sophisticated yet comprehensible approach to options valuation. This pioneering options pricing model, specifically tailored for European options, employs a meticulous mix of input variables to ascertain the theoretical value of an option. These variables synergize to unravel the complexities encapsulated within an option’s price, providing a standardized benchmark for options valuation.

- Strike Price of the Option (K)

- Current Stock Price (S)

- Time to Expiration (τ)

- Risk-Free Interest Rate (r)

- Volatility of the Stock (σ)

Pooling these inputs, the formula represents a balancing act between various market forces that impact the option’s present worth. It magnetizes investors by providing a clear-eyed estimation of an option’s future, devoid of the clutters of market unpredictability.

| Input Variable | Description | Significance |

|---|---|---|

| Strike Price (K) | The agreed-upon price for the option’s execution | Dictates the intrinsic value threshold for profit realization |

| Current Stock Price (S) | The current price of the underlying stock | Indicates immediate investment potential |

| Time to Expiration (τ) | The duration until the option can no longer be executed | Affects the option’s time value and chance to mature in the money |

| Risk-Free Rate (r) | The theoretical return on an investment with zero risk | Used to discount the expected payoff to present value |

| Volatility (σ) | The measure of the stock’s price fluctuations over time | Captures the uncertainty and potential for diverse price paths |

Employing the Black Scholes formula, the price of a call option (C) is symbolically rendered as the current stock price (S) multiplied by the cumulative normal distribution of d1, minus the present value of the strike price (K) multiplied by the cumulative normal distribution of d2:

C = S * N(d1) – K * e^(-rt) * N(d2)

Here, the functions N(d1) and N(d2) are the cumulative standard normal distribution functions, with d1 and d2 signifying calculated variables based on the initial input parameters. This expression can be dissected to understand how market factors and investor sentiments are mathematically interwoven to spell out the nuanced valuation of a European option.

The Black Scholes formula remains a pivotal discovery, enlightening the pathway towards efficient and precise options pricing. Its enduring relevance in today’s financial markets attests to the rigor and insightfulness of its creators, ensuring a lasting legacy within the realm of financial theory.

Exploring the Five Key Variables of the Black Scholes Model

The Black Scholes Model has stood the test of time for its robust approach to options valuation. Core to this model are five key variables, each playing a critical role in the complex tapestry of options trading. Understanding these components is vital for market participants to execute informed financial derivatives strategies and to conduct effective risk assessment.

The Role of Strike Price and Stock Price

Firstly, the strike price is the predetermined price at which an option contract can be exercised. It is a threshold that dictates whether the option will have intrinsic value at expiration. The stock price, representing the current price of the underlying asset, directly impacts the option’s intrinsic value – the value if the option were exercised at that moment. Variations in the stock price could alter the payoff profile of the option, affecting the calculus of options trading and market volatility.

Time to Expiration and Risk-Free Rate Explained

Time to expiration denotes the period left until the option expires. This duration is a major determinant of the option’s time value – a part of the option’s premium that erodes as the expiration date nears, assuming all other factors remain equal. Another key component is the risk-free interest rate, which discounts the option’s payoff from the future to the present, applying the time value of money concept to option valuation.

Understanding Volatility in Option Pricing

The last, but certainly not least, critical variable is volatility. Often referred to as “the heart of the Black Scholes Model,” it quantifies the extent to which the stock price is expected to fluctuate over the option’s life. Here lies the distinction between Black Scholes volatility, which is assumed constant in the model, and implied volatility discerned from the market prices of options, often fluctuating with market perceptions of risk and uncertainty.

Below, a table has been meticulously composed to delineate the said variables, each with palpable sway over financial derivatives and their pricing:

| Variable | Definition | Influence on Option Value |

|---|---|---|

| Strike Price (K) | Price at which an option contract can be exercised | Determines exercise profitability threshold |

| Stock Price (S) | Current price of the underlying asset | Affects intrinsic value and potential profitability |

| Time to Expiration (τ) | The remaining life of the option | Impacts time value component of an option’s premium |

| Risk-Free Rate (r) | Theoretical return of a riskless investment | Used to discount future payoffs to present terms |

| Volatility (σ) | Expected fluctuation magnitude of stock price | Models the stock’s future price uncertainty |

The meticulous integration of these variables into the Black Scholes Model is what powers its capacity to reflect an option’s theoretical price. However, the interplay of factors like Black Scholes volatility, market volatility, and the time value of money creates a dynamic scenario where risk assessment and valuation become as much an art as it is a science in the domain of financial derivatives.

The Underlying Assumptions of Black Scholes

The efficacy of the Black Scholes Model for pricing European options is rooted in a few critical assumptions that are pivotal to its operation. Market participants and financial strategists employ the model under the pretext that these underlying assumptions hold true. These assumptions delineate the boundaries within which the model works best, providing a framework for risk-neutral pricing while discounting any prospects of arbitrage.

It’s important to understand that these assumptions, while foundational, can lead to differences between theoretical outcomes and actual market behaviors. This knowledge can enhance the user’s application of the model, particularly in random markets replete with uncertainties. Let’s dissect these Black Scholes assumptions to appreciate the model’s intricacies:

- The model presupposes that no dividends are paid out during the option’s life, which influences the cost of carrying positions.

- Markets function under the premise of randomness, meaning that past or current stock prices cannot predict future movements.

- Transactional costs, whether they be fees associated with trading or costs of short selling, are assumed non-existent.

- Interest rates are known and remain constant over the option’s duration, providing a reliable discount rate for present value calculations.

- The volatility of the underlying asset is also assumed to remain unchanged, simplifying the model’s outlook on market movements.

- Returns of the underlying asset follow a lognormal distribution — a critical point for the calculation of option prices.

- Lastly, the model is tailored for European options, which are characterized by the fact that they can only be exercised at expiration.

Comparatively, here’s a table showcasing how each assumption plays a part in the possibility of no arbitrage opportunities, a key factor in financial derivatives pricing:

| Assumption | Contribution to No Arbitrage |

|---|---|

| No dividends | Eliminates potential for profit from dividend payments within the option’s life. |

| Random markets | Averts a predictive approach to pricing, encouraging fairness. |

| No transaction costs | Ensures pricing that exclusively reflects market dynamics, disallowing exploitation of fees or costs. |

| Constant interest rate | Sustains steady discount rates, securing uniformity in pricing methodology. |

| Constant volatility | Presumes uniform risk throughout the life of the option, standardizing the pricing formula. |

| Lognormal asset returns | Supports the model’s foundation for probabilistic option pricing. |

| Exclusivity to European options | Ensures pricing is based on a single exercise opportunity, reducing complexity. |

The discernment of the constant volatility assumption in particular, calls for highlighting how actual market conditions can differ from theoretical models. Volatility, invariably, is subject to change based on unfolding market events.

In accordance with these principles, the model omits certain realistic factors of the markets that can affect the true value of options. Hence, while the Black Scholes Model is a triumphant theoretical construct and a benchmark tool for valuing options, investors and traders must synthesize it with practical observations and market sentiments to ensure comprehensive financial modeling and execution.

Retaining the axiomatic foundations ensures the model’s utilitarian relevancy, enriching its role as a steadfast resource in the education and practice of financial derivatives pricing.

Practical Applications of Black Scholes in Options Trading

The Black-Scholes-Merton model, a cornerstone of quantitative finance, has dramatically shaped the ways in which European options are priced and traded. Its rigorous application in financial modeling ensures that market participants can approach options trading with refined wisdom and mathematical precision.

Using the Model for European Options

The unparalleled precision offered by the Black Scholes options pricing model has cemented its place as the standard approach for European options, revered for its robust ability to apply rigorous theoretical frameworks to real-world trading scenarios. European options, which uniquely can only be exercised at the point of expiration, align neatly with the foundations of the model, enabling options traders to capitalize on the meticulous nature of option valuation models.

The Black Scholes Model excels in the domain of European options through its adept handling of the delicate interplay of factors that determine an option’s value.

How Traders Leverage Black Scholes Model Today

Today, harnessing the Black-Scholes-Merton model’s power incorporates leveraging cutting-edge options calculators and platforms that integrate the model’s framework into their systems. The increasingly sophisticated nature of derivative pricing has given rise to tools that automatically generate theoretical values, assess potential financial derivatives positions, and calculate risk parameters—all essential elements in refining options strategies within quantitative finance.

Moreover, the adaptability of the model has seen it extend to account for dividend distributions, a critical component for traders eyeing stocks prone to payout earnings. By calculating the ex-dividend date value of the underlying asset, the model adjusts to reflect the potential reduction in asset value post-dividend payout.

Enhanced capabilities have evolved from this storied model, enabling portfolio managers to tailor their financial modeling practices to fit the needs of a changing market landscape. This encompasses not just theoretical pursuits but extends to practical applications where the Black-Scholes-Merton model serves as a lynchpin for quantitative finance deep-dives and monetary decision-making.

Summarized here is a table demonstrating the model’s versatile influence across pivotal trading considerations:

| Trading Consideration | Influence of Black Scholes Model |

|---|---|

| Pricing Accuracy | Options pricing is refined through a theoretical framework informed by market inputs and mathematical rigor. |

| Risk Management | Generates variables that allow for a quantitative examination of potential risks and rewards. |

| Dividend Adjustments | Adapts to changes in underlying asset value due to dividends, offering a real-time reflection of market conditions. |

| Technology Integration | Introduces automated calculation tools that assist traders in valuation without the necessity for manual intervention. |

Reflecting on the applications of the Black-Scholes-Merton model in contemporary finance, it is clear that its ingredients are not solely of academic interest but are essential components of the options trader’s toolkit. By interpreting complex market signals through the lens of the model, traders are afforded a pathway to understanding and capitalizing on options trading opportunities in a sophisticated manner, reconciling theory with practice.

As the financial markets continue their relentless evolution, the practicalities of the Black-Scholes options pricing system remain integral, a testament to its durability and enduring relevance in the intricate world of financial derivatives.

Adjustments and Adaptations of the Original Formula

Since its inception, the Black Scholes formula has been the gold standard in options pricing. However, as the financial markets evolved, its initial parameters required updates to maintain relevance, particularly when pricing American options. These traditional options differ from European options, as they allow for exercise at any point up to the expiration date. This flexibility necessitates a more dynamic approach to pricing models.

An example of the Black Scholes formula adaptation can be seen in modifications that incorporate the volatility skew, a reality observed post the 1987 market crash, reflecting that the implied volatilities differ for options “in the money” (ITM) and “out of the money” (OTM). Changes must also be made to the original formula to account for dividends, a feature that affects an option’s underlying assets.

Here, the Bjerksund-Stensland model emerges as a significant contender for it is specifically designed to handle the complexities of American-style options. This adjusted pricing model provides a more tailored solution than the original Black Scholes formula, which was primarily designed for European options that are devoid of exercise opportunities prior to expiration.

Let’s explore how some of these adaptations have impacted the original Black Scholes model:

| Adaptation | Impact on Pricing | Reason for Adaptation |

|---|---|---|

| Dividend Adjustments | Accounts for the decrease in asset price due to dividend payouts. | To calculate a more accurate price reflecting potential declines in stock price post-dividend. |

| Volatility Skew Incorporation | Allows fluctuating implied volatilities across different strikes. | To respond to market observations where out-of-the-money options carry higher implied volatilities. |

| Bjerksund-Stensland Model | Serves American options through a closed-form approach. | To provide a viable alternative for pricing American options prior to their expiration. |

Option-selling market makers faced with the challenge of American options have also engineered custom adjustments. This often involves tweaking volatility inputs and employing iterative methods to align the theoretical value with market expectations. It is not uncommon to see professionals utilizing a blend of the Black-Scholes and binomial/trinomial pricing methods to approximate values more suited to the American market context.

“As the trading landscape broadens, so does the horizon of pricing models. The Black Scholes model serves as a starting point, but the real art lies in adapting to the contours of modern financial instruments.” – An industry expert on options pricing.

- Volatility adjustments reflecting the present market sentiments.

- Dividend discounting aligning with corporate actions and financial calendars.

- Advanced algorithms that can pivot for the early exercise feature of American options.

Through these pivotal adjustments, the Black Scholes model continues to influence pricing mechanisms, albeit in a transformed avatar that speaks to the nuanced demands of the existing financial derivatives market.

Comparison with Other Options Pricing Models

In financial derivatives pricing, varying methodologies offer unique perspectives and adapt to distinct market conditions. While the Black-Scholes model has been paramount in options modeling, it is one of many tools available to financial professionals. Here, we explore comparative models such as binomial option pricing and trinomial models, as well as the application of Monte Carlo simulations in option valuation.

Binomial and Trinomial Models

The binomial option pricing model presents a discrete-time framework for valuing options, particularly adept at accommodating the special features of American options. It operates by constructing a binomial tree to model the possible paths an underlying asset’s price can take leading up to expiration. The trinomial model extends this approach by allowing for three potential movements: up, down, or unchanged. These models shine in their ability to calculate the option’s value at every point throughout its life, thereby allowing for the possibility of early exercise intrinsic to American options.

“Binomial and trinomial models are key in the toolkit for derivative pricing due to their flexibility in handling early exercise opportunities available in American options.”

| Black-Scholes Model | Binomial/Trinomial Models | |

|---|---|---|

| Option Style | European options | American and European options |

| Early Exercise | Not accommodated | Facilitates evaluation |

| Computation | Closed-form equation | Iterative through tree nodes |

| Dividends | Not initially considered | Easily incorporated |

Monte Carlo Simulations in Option Valuation

Monte Carlo simulations introduce a probabilistic method in financial modeling, often championed for its adeptness at handling a variety of complex derivatives and market uncertainties. This model employs random sampling to simulate thousands of potential outcomes of uncertainty factors affecting the pricing of financial derivatives, building a predictive distribution of prices. The flexibility to incorporate multiple risk factors and the stochastic nature of assets makes it a formidable contender to the Black-Scholes model, particularly in situations where path dependency and various sources of market risk are present.

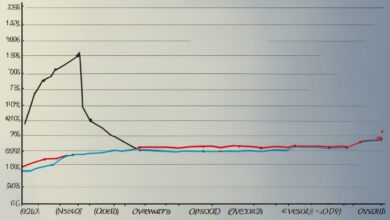

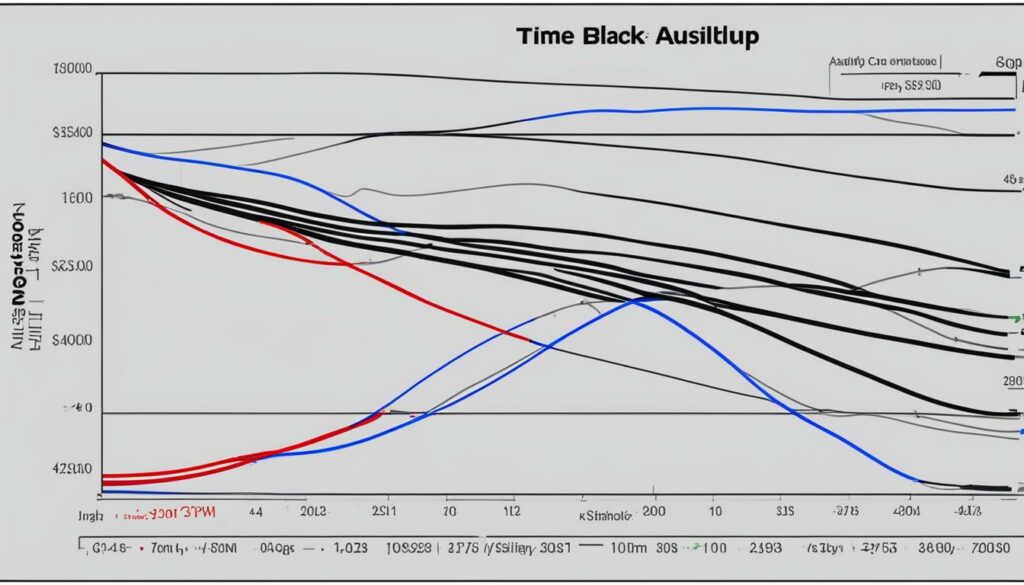

A visual representation encapsulates the broad usage of Monte Carlo simulations in today’s option valuation model landscape:

| Aspect of Valuation | Role of Monte Carlo Simulations |

|---|---|

| Market Uncertainty | Factoring in various market scenarios and volatilities |

| Path Dependency | Valuing options whose payoff is influenced by the path of the underlying asset |

| Risk Management | Simulating a wide range of risk factors for robust risk analysis |

| Complex Derivatives | Applicable to exotic options and contingent claims |

Both binomial/trinomial models and Monte Carlo simulations address limitations within the Black-Scholes framework, offering more tailored approaches to risk management and derivative pricing. The choice among these methods is heavily influenced by the specific facets of the options under evaluation and the prevailing conditions of the stock market analysis.

- Binomial and trinomial models provide granularity for American options and early exercise considerations.

- Monte Carlo simulations excel in pricing complex options where multiple risk factors and market uncertainties must be taken into account.

Each model has its own strengths and use cases, highlighting the importance of a diverse set of tools at the disposal of those engaged in the nuanced world of options modeling and financial derivatives pricing.

Understanding the ‘Greeks’ in Black Scholes Model

In the realm of options trading, the Black Scholes equation stands as a testament to financial modelling accuracy. Integral to this model are the option Greeks, which are primarily risk factors that provide traders with a profound insight into the sensitivity analysis of options. Knowing the Greeks is paramount in managing and strategizing investments in an often unpredictable market. They quantify various dimensions of risk tied to the value of an option, and herein we divulge into key Greeks such as delta, gamma, vega, and theta.

| Greek | Measure of Sensitivity | Application in Trading |

|---|---|---|

| Delta (Δ) | Rate of change in option price per unit change in underlying asset price | Assessing the directional risk of an option portfolio |

| Gamma (Γ) | Rate of change in delta per unit change in underlying asset price | Understanding the stability of an option’s delta |

| Vega (ν) | Rate of change in option price per unit change in volatility | Evaluating the sensitivity of an option’s value to volatility in the market |

| Theta (Θ) | Rate of change in option price per unit time decay | Optimizing the timing of option buying or selling |

Delta holds the fort as the most referred to Greek, often considered the first derivative of the option’s value relative to the underlying asset’s price. It provides a gauge to risk factors associated with price movements and is essential in hedging portfolios. Traditionally seen as the “hedge ratio,” it assists investors in making informed decisions about options position sizing and expected profit or loss.

In a landscape where tiny changes can imply significant risks, Gamma assists traders in grasping the rate at which delta will change. This knowledge aids in understanding an option’s sensitivity to movements in the underlying asset and informing traders about the stability, or convexity, of their options’ positions.

The essence of Vega lies in its ability to measure an option’s exposure to volatility. Since volatility is a cornerstone of an option’s price, especially in a market where dramatic turns can be unexpected, Vega serves as a crucial element in constructing risk-mitigated options trading strategies.

Time decay is an inevitable facet of options, and Theta is the Greek that measures the rate at which an option’s price decreases as the expiration date approaches. Traders keen on exploiting the time decay aspect for premium writing strategies consider Theta to be an invaluable indicator.

The Greeks serve as the navigational stars in the universe of options trading, guiding through the night sea of market risk and opportunity.

- Delta: Provides directionality and hedge ratio.

- Gamma: Advises on the stability of delta, crucial during large market moves.

- Vega: Vital for understanding response to market volatility shocks.

- Theta: Essential for capitalizing on the erosion of time value.

Armed with the prowess of the Black Scholes Model and the option Greeks, traders can deftly orchestrate a symphony of strategic moves in options trading. The ability to dissect, comprehend, and apply these Greeks in real-time underscores the analytical edge and predictive control they afford in the complex confluence that is the financial market.

Assessing Market Movements and Volatility Skew

The landscape of the options market is often characterized by abrupt market movements that confound the normal distribution forecasts applied in traditional financial models such as Black Scholes. A particular manifestation of this complexity is the volatility skew, a slant in the implied volatility graph which suggests disparities in anticipated market risk for options set at different strike prices. It’s this skewing of volatility that challenges core aspects of options pricing theory and necessitates an astute understanding of option greeks to manage the idiosyncrasies of the trading environment accurately.

“Market realities often diverge significantly from model-based predictions, underscoring the need for astute real-time adjustments based on observed implied volatility.” – Financial analyst on market dynamics.

One of the essential analytical tools available to traders in assessing market risk and movements is the range of metrics known as option greeks. These measures enable traders to dissect and quantify the sensitivity of options to various factors such as price movements, interest rate changes, and time decay. Here, we delve into how the volatility skew influences these measures and, by extension, our approach to options valuation.

| Greek | Description | Impact of Volatility Skew |

|---|---|---|

| Delta (Δ) | Change in option price per unit change in underlying asset price | Volatility skew can indicate higher risk of large downward moves, affecting delta hedging strategies |

| Vega (𝜈) | Change in option price per unit change in implied volatility | Skew altercations adjust the sensitivity of the option price to shifts in implied volatility levels |

| Gamma (Γ) | Change in delta per unit change in underlying asset price | During pronounced skews, gamma will fluctuate more rapidly for OTM and ITM options, signaling heightened risk |

| Theta (𝜃) | Change in option price per day | Options closer to expiry with significant skew might have theta affected, as risk perception changes |

The concept of volatility skew makes it evident that straightforward applications of models such as Black Scholes might be misleading. While Black Scholes assumes a log-normal distribution of returns and constant volatility, real-world scenarios depict a different picture — markets often witness asymmetries due to various reasons such as economic announcements, geopolitical tensions, or sudden changes in investor sentiment.

- Implied volatility often spikes for deep out-of-the-money (OTM) put options, signifying a larger market expectation of a downturn.

- Moderation of implied volatility for at-the-money (ATM) options often suggests range-bound market expectations.

- Long-dated options tend to exhibit less prominent skews, as short-term uncertainties play a smaller role.

To gain a rounded comprehension of market movements and the volatility skew, traders must blend the theoretical underpinnings of Black Scholes with dynamic market observation and agile adjustment of their risk assessment strategies. The usage of option greeks in this regard thus becomes a key mechanism for balancing the scales between model-driven expectations and market-driven realities in the realm of options trading.

Real-world Limitations of the Black Scholes Model

While the Black Scholes Model marks a transformative approach to options pricing theory, its practical limitations underlie the critical difference between financial model accuracy and market volatility. As market practitioners apply this famed model, they must navigate the nuances of implied volatility and real-world market dynamics that can deviate substantially from the assumptions of Black and Scholes.

One of the salient Black Scholes limitations is its treatment of volatility as a static factor—assuming it remains constant over the life of the option. This assumption is at odds with real market volatility, which is inherently erratic and influenced by global events, economic data, and investor sentiment. Such simplification can engender discrepancies in the model’s predictive efficacy, underscoring the importance of dynamic risk management strategies in finance.

Another crucial limitation surfaces in the pricing of American options. The Black Scholes Model primarily addresses European options, which can only be exercised at expiry, leaving the early exercise characteristic of American options outside its analytical purview. This oversight necessitates alternative models that can accommodate the complexity of American options’ valuation nuances.

Moreover, real-world financial markets encounter fluctuating interest rates and continuous dividend payouts, which can markedly affect an option’s pricing. The original Black Scholes Model does not account for shifting interest rates and treats dividends as nonexistent, which, in today’s dividend-active market, limits its preciseness.

“The Black Scholes Model, a pillar in options pricing theory, must be viewed with the perspective that key assumptions do not always hold up against the backdrop of dynamic financial market conditions.” – Financial Model Analyst

To gain a comprehensive understanding of the Black Scholes limitations, the following table articulates some of its key assumptions against their real-world market realities, revealing why adaptations are often necessary for true financial model accuracy:

| Black Scholes Assumption | Real-World Market Condition | Implications for Option Valuation |

|---|---|---|

| Constant Volatility | Fluctuating Market Volatility | May lead to underpricing or overpricing of risk, depending on market conditions. |

| No Dividends Paid | Dividends Impact Stock Prices | Model overvalues options on dividend-paying stocks, as dividends reduce stock price. |

| European Options Only | American Options Prevalent | Inability to value options that can be exercised prior to expiry, limiting its use in American markets. |

| Constant Interest Rates | Variable Interest Rates | Changes in interest rates over the options life can skew the discount rate, impacting the theoretical price. |

These Black Scholes limitations pave the way for enhanced models and a multifaceted approach to options valuation. They prompt the gateway for the integration of sophisticated financial tools and iterative techniques, which aim to bridge the divide between theoretical elegance and market volatility realities. Risk management teams, armed with this knowledge, are better positioned to fortify their strategies against the unforeseen vicissitudes of financial markets.

Conclusion: The Enduring Legacy of the Black Scholes Model in Options Pricing

The Black Scholes Model continues to anchor its legacy within the realms of mathematical finance and financial theory, symbolizing a paradigm shift in the approach to stock market pricing and the valuation of option pricing model derivatives. Undeniably, it has bestowed upon us a framework for risk-neutral pricing — a cornerstone in contemporary quantitative finance. Yet, its practical utilization, amidst the tumultuous seas of market variables, indicates a need for nuanced applications and adjustments that concede to the inherent limitations when juxtaposed with real-world complexities.

In understanding the model’s underpinnings and its foundational impact on derivative pricing, financial professionals are equipped with the necessary foresight to navigate the intricacies of options markets. The Black Scholes Model, despite facing empirical scrutiny, maintains its position at the core of option pricing theory. It endows the financial community with a sophisticated, albeit theoretical yardstick, while inspiring ongoing innovations aimed at closing the gap between model projections and the unpredictability of market volatility.

As the model endures and adapts through successive financial epochs, its original form garners respect for the mathematical elegance and revolutionary impetus it has provided to the world of finance. The journey from theory to practice shows that while the Black Scholes Model may not singularly suffice, it remains profoundly integral to the tapestry of modern finance, bolstering the mechanisms through which we perceive and interpret the valuations of financial securities in a perpetually evolving economic landscape.

FAQ

What is the Black Scholes Model?

The Black Scholes Model, also known as the Black-Scholes-Merton (BSM) model, is a mathematical model used for pricing financial derivatives, particularly options. Developed by Fischer Black, Robert Merton, and Myron Scholes in 1973, it calculates the theoretical value of options by considering variables such as stock price, strike price, volatility, time to expiration, and risk-free interest rate.

How is the Black Scholes Model used in modern finance?

The Black Scholes Model is used to estimate the fair value of options, providing a benchmark for traders and investors. It helps in risk management by predicting the risk exposure of different assets. Furthermore, it aids in financial modeling and contributes to the pricing efficiency across various markets.

What are the key inputs in the Black Scholes formula?

The key inputs of the Black Scholes formula include the current stock price, the strike price of the option, the time to expiration, the risk-free rate, and the volatility of the stock’s returns. These factors are used to calculate the theoretical price of European options, which can only be exercised at expiration.

Why is volatility important in the Black Scholes Model?

Volatility measures the stock’s expected price fluctuations over the life of the option and is a crucial input in the Black Scholes Model. It impacts the probability of the option ending in-the-money, which in turn affects the premium or price of the option. The model assumes a constant volatility, a simplification that can affect the accuracy of the theoretical price.

What are some fundamental assumptions behind the Black Scholes Model?

The model assumes that markets are efficient and the stock prices follow a log-normal distribution. Other assumptions include no dividends are paid out during the life of the option, no transaction costs, a constant risk-free rate and volatility over the option’s life, and the options being of the European type that cannot be exercised early.

How has the Black Scholes Model been adapted for practical use?

The original Black Scholes Model has seen adaptations to better fit real-world scenarios, such as incorporating dividends and adjusting for American options which can be exercised before expiration. These adaptations include adjustments to the input parameters and developing alternative models like the Bjerksund-Stensland, to account for early exercise opportunities.

How do the ‘Greeks’ relate to the Black Scholes Model?

The ‘Greeks’ are risk measures derived from the Black Scholes Model that quantify the sensitivity of the option price to various factors. These include Delta (price change), Gamma (Delta’s change), Vega (volatility change), and Theta (time decay). Traders use the Greeks to manage option risks and devise strategies.

What is a volatility skew and how does it relate to the Black Scholes Model?

Volatility skew refers to the pattern where implied volatility varies for options with different strike prices or expiration dates. This observation contradicts the Black Scholes Model’s assumption of constant volatility and affects option pricing by accounting for the market’s view of risk for different strike prices.

What are some limitations of the Black Scholes Model when applied in real-world trading?

In practice, the Black Scholes Model’s limitations arise from its theoretical assumptions which often differ from market realities. These include assuming a constant volatility and ignoring the possibility of early exercise for American options, as well as not factoring in changing interest rates and the true distribution of stock price returns, which can lead to pricing inaccuracies.