Synthetic Long Options Strategy: How It Works & When To Use It

In the realm of options trading, our pursuit of effective financial strategies often leads us to innovative avenues—one such avenue is the synthetic long options strategy. This potent financial strategy emulates traditional stock ownership without necessitating the full capital investment typically required. Our focus is on a synthetic approach engineered through the convergence of two pivotal components: buying a call option, and selling a put option, both at synchronized strike prices and expiration dates.

We leverage this synthetic options tactic to harness the potential for unlimited profit if the stock ascends above the set strike price. Conversely, should the stock descend below our predetermined threshold, we find ourselves automatically positioned to acquire the stock at the strike price. In essence, this investment strategy represents a method to attain a stake in the upward movement of a stock, mitigating the need for substantial upfront capital, and reducing the immediacy of impact from volatility fluctuations.

Key Takeaways

- A synthetic long options strategy enables investors to mimic stock ownership with less capital.

- The strategy comprises two simultaneous moves: buying a call and selling a put at an identical strike price and expiration.

- There is an unlimited profit potential if stock prices rise, paralleling the gains of direct stock ownership.

- Investors face a loss potential that extends down to zero, correlating with declines in the stock price.

- Breakeven points are determined by the structure of the initial options transaction, whether as a credit or a debit.

- This strategy is often favoured for its minimal sensitivity to shifts in implied volatility.

Understanding Synthetic Long Options Strategy

As we delve into the mechanics of options trading, it’s crucial for us, as investors, to grasp the intricacies of various strategies available within our investment arsenal. Among these strategies, the long options strategy shines as a beacon for those with bullish aspirations yet a cautious approach to risk. Notably, the synthetic stock position stands as a centrepiece of such a strategy, offering a compelling blend of growth potential and controlled risk exposure.

At its core, the synthetic long options strategy, often referred to as a synthetic long call or married put, caters to investors looking to simulate the performance of being long on a stock. Yet, it does so without the full financial commitment that comes with outright stock ownership. **This economic dexterity is achieved through combining stock shares with a put option.**

We engage in a synthetic long options strategy not by chance, but as a deliberate mechanization designed to hedge against potential downturns and uncertainties in the near term, all the while maintaining the advantages that accompany owning stock, such as the receipt of dividends and the privilege to vote in corporate matters.

The term ‘synthetic’ in this context is apropos, as it denotes a concoction of financial instruments meticulously crafted to mirror another asset’s risk-and-reward profile. In the case of a synthetic long position, an investor purchases put options as an insurance policy against a downtrend, ensuring a safeguarded basement for the stock’s value—a floor below which the investor’s losses cannot fall further.

- In this strategy, the marriage of a long call and a short put at the same strike augments our bullish stance.

- Our objective remains steadfast in capital preservation, carried forth under the wing of the protective put.

- We accept, embrace, and exert leverage to widen the horizons of our investment maneuvers, all with a manageable outlay of capital.

The protective floor established through this strategy imparts a significant defensive posture against stock depreciation. This edge in trading mechanics allows us to operate from a position of strength, as the long options strategy unfolds.

| Strategy Component | Role in Synthetic Long Strategy | Investor Benefit |

|---|---|---|

| Long Call Option | Mimics stock ownership with bullish outlook | Unlimited profit potential |

| Short Put Option | Finances long call; sets loss floor | Limited downside risk |

| Combination of Both | Emulates call option’s exposure | Reduced capital requirement |

For us, the synthetic stock position isn’t a mere financial construct; it’s an embodiment of options trading mechanics brought to life through the seamless integration of calls and puts. As we navigate the markets, wielding such powerful strategies is akin to having an ace up our sleeve, geared towards not just surviving but thriving in the dynamic world of investing.

Components of a Synthetic Long Position

For those of us with an investment horizon colored by bullish expectations, the synthetic long position forms an essential part of our strategy playbook. This section illuminates the components that make this strategy a dynamic way to simulate stock ownership and illustrates the powerful synergy between calls and puts.

The Role of Call Options

At the heart of the synthetic long position, **call options** are the engines driving our bullish market strategy. In this approach, we purchase at-the-money call options, unlocking the door to **options leverage**. Such a move positions us to capitalize on any rise in the underlying asset’s price. It’s the main thrust of our bullish outlook, helping us maximize potential gains with the added benefit of not tying up the full cost of stock ownership.

Implementing Put Options

Equally crucial to our strategy mosaic are **put options**. By selling these put options, we create what’s often termed **synthetic long puts**. This acts as a financial bulwark, offering **downside risk protection**. It finances our long call position, simultaneously establishing a floor on the potential losses, and aligning perfectly with our capital preservation ethos.

Strike Price and Expiration Synergy

The art of strategic optioning lies in the mastery of time and value. Therefore, we ensure the options involved in our trading maneuvers share the same **strike price** and **expiration date**, crafting a harmonious options strategy synergy. This exact alignment enables us to emulate stock ownership effectively while granting us the flexibility to manage the position across various market scenarios—be it capital appreciation or hedging against downturns.

We sculpt our synthetic long positions using the dual clay of calls and puts, shaping a financial instrument with the precision of a maestro—an orchestra of potential profit and risk management playing to the tune of market rhythms. This is the hallmark of a seasoned, savvy investor.

| Option Type | Role | Strategic Advantage |

|---|---|---|

| Call Option | Leverage on upward price movements | Access to unlimited profit potential |

| Put Option | Protection against price declines | Downside risk mitigation |

| Synergy of Both | Cohesive bullish strategy | Optimized balance of risk and reward |

By weaving together these components with careful deliberation, we give life to an options trading strategy that brims with potential—a testament to our investment acumen and anticipation of bullish market dynamics.

The Financial Mechanics Behind Synthetic Long Calls

Within the fertile landscape of options trading, synthetic long calls stand as a striking example of financial ingenuity. We navigate these trading strategies with the finesse of a skilled artisan, threading the needle between risk and reward. As we initiate a **synthetic long call**, we essentially establish a bullish position on a stock without the hefty financial commitment of direct stock ownership.

The elegance of this approach lies in its financial mechanics—a duality where one part complements the other, adding robustness to our position. We purchase a call option, riding the wave of the stock’s potential ascent, unbridled by any restraint on profit. The crystal clear advantage: should the stock soar, our profits may climb indefinitely, tethered only by the market’s grace.

We embark upon synthetic long calls not as wild gamblers unfurling their sails to the wind, but as tactical traders, discerning and strategic in our commitments.

Simultaneously, we deploy a short put option to this mix—a counterbalance that serves us well. Not only does it inject premium income into our trading account, offsetting the long call’s cost, but also, in ideal conditions, this maneuver can usher in a net credit, enriching our financial toolbox with its versatility.

| Options Strategy Component | Financial Impact | Strategic Purpose |

|---|---|---|

| Long Call Option | Provides unlimited upside | Bullish position enables capitalizing on stock’s upward trajectory |

| Short Put Option | Generates premium income | Offsets long call cost, potentially translating to net credit |

Our foray into synthetic long calls is dictated by a clear-eyed analysis of options financial mechanics, pinpointing the convergence where strategy and economics harmonize. We craft our trading strategies with an acute awareness of their native strengths and limitations, ever vigilant to the siren calls of market flukes and fervors.

Together, the coalescence of a long call and its short put counterpart culminates in an options strategy that is emblematic of our refined investment philosophy—one that wields the shrewdness of leverage against the tumultuous seas of market fluctuations.

Predicting the Break-even Point

As investors using a synthetic long position in our portfolio, understanding the break-even point calculation is crucial for effective options strategy analysis and reliable investment predictions. This pivotal metric illuminates the threshold where our position neither gains nor loses value, marking the start of profitability or the risk of potential loss. Knowing our break-even point with precision aides in our pursuit of informed and measured investment choices.

Drilling into the specifics, the calculation method for determining the break-even point of our synthetic long position varies depending on initial conditions of the trade. In cases where we’ve orchestrated our options strategy to enter at a credit, we calculate break-even by deducting the premium received from the strike price. This essentially becomes our safety net, below which our position starts to incur losses.

Conversely, in scenarios where our position commences with a debit, adding the paid premium to the strike price provides us with the break-even threshold. This number serves as a beacon, guiding us through the murky waters of market fluctuations and assisting us to anchor our investment strategies in solid foresight.

With precise break-even point analysis, we clear the fog of uncertainty, charting a course through the complex sea of options trading.

Let’s quantify these concepts with an example for clarity:

| Scenario | Strike Price | Premium Paid/Received | Break-even Point |

|---|---|---|---|

| Entered at Credit | $100 | -$1.00 (credit) | $99 |

| Entered at Debit | $100 | +$1.00 (debit) | $101 |

This table exemplifies how distinct entry points influence our break-even calculations. In both cases, though, awareness and anticipation of the break-even point empower us to fortify our strategies against market variances, thereby amplifying the efficacy of our bullish outlook.

By holding steadfast to a calculated break-even point, we, as investors, forge ahead, not as gamblers relying on chance but as strategists armed with knowledge and prudence. This singularity of approach, rooted in a deep understanding of strategic metrics like the break-even point, solidifies our standing in the options trading arena, giving us the much-needed competitive edge.

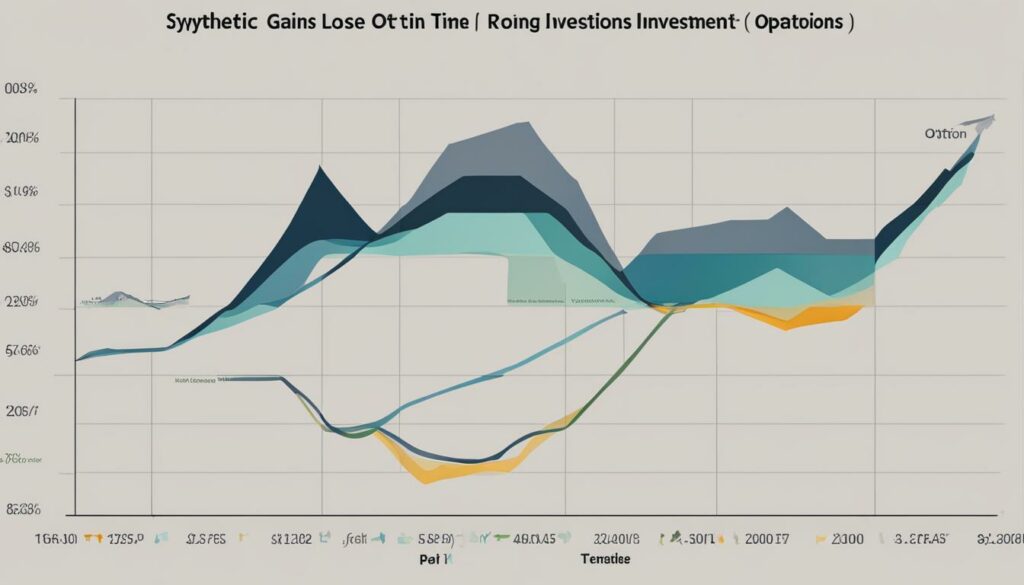

Calculating Maximum Profit and Loss

When deploying synthetic options strategies, we position ourselves at the intersection of aspiration and prudence, meticulously crafting our blueprint for maximum profit and astute risk management. It is here, in the arena of synthetic longs, where we find the potential for theoretically boundless gains, juxtaposed with considerations of discernible risks that compel us to tailor our approaches with foresight and precision.

Understanding the realms of possibility and peril begins with a robust maximum profit loss calculation. To master this equation is to command the foresight necessary to navigate the waves of the market. On the one hand, we bask in the glow of unlimited profit, a horizon that stretches as far as the stock’s ascension will carry it. On the other, we acknowledge the cavernous potential for loss, extending down to a nadir where the stock value might rest at zero.

It is with this balance—this tradeoff between boundless opportunity and pointed risk—that we calibrate our instruments for a journey through the financial markets.

| Stock Movement | Impact on Synthetic Long Strategy | Profit/Loss Considerations |

|---|---|---|

| Upward Trajectory | Unlocking unlimited profit potential | Profit amplifies as the stock price rises |

| Downward Decline | Scene set for accruing losses | Losses escalate as stock price approaches zero |

| Stability at Strike Price | Break-even point where gain meets loss | No profit or loss, excluding transaction costs and premiums |

As custodians of our investments, we employ synthetic options strategies not only to propel us toward a landscape of prosperity but also to shield our stakes from the churning uncertainties beneath. It is through diligent risk management that we plot the coordinates for our envisioned gains, drawing upon the calculated leverage of options to elevate our strategy above conventional constraints.

- We revel in the exhilaration of unlimited profit as our call option values inflate with soaring stock prices.

- Yet, we temper our optimism with the caution of a put option placed, a bulwark against the descent into financial abyss.

- Our risk is meticulously calculated, our prospects for gain envisioned, yet tethered always to the tangible realities of the market’s ebb and flow.

We shoulder the mantle of responsibility with the gravitas it demands, recognizing that the synthetic long options strategy presents a crucible from which our financial acumen is both tested and potentially rewarded. It is with a blend of bold ambition and strategic calculation that we chart our course, seeking the rewards of investment while prepared for the vicissitudes of an ever-changing market landscape.

Strategic Advantages of Synthetic Long Strategies

Synthetic long strategies have surfaced as a prime example of financial innovation, providing us with a suite of strategic advantages in the realm of investment. Remarkably akin to holding the actual stock, these strategies beckon with the promise of limitless profit potential while strategically sidestepping the substantial capital requirements traditionally associated with stock ownership.

A crucial allure of synthetic long strategies lies in its ability to replicate the profit trajectory of straightforward stock ownership; yet, it distinguishes itself with a markedly reduced capital burden. We find ourselves empowered to inaugurate sizable market positions with a fraction of the outlay, significantly lowering our monetary barrier to entry.

Through the lens of synthetic long strategies, we envision new pinnacles of financial acumen, where capital exerts a multiplied force, and savvy investment plays redefine the bounds of profitability and risk management.

Moreover, these strategies allow us to sculpt our investment portfolios with precision, crafting our reward and risk objectives with the agility that only options can afford. This bespoke tailoring of investment outcomes leverages the potent combination of both the call and the put, which, when wielded judiciously, magnifies our tactical flexibility in bullish market conditions.

- We engage in strategic plays that mirror the growth trajectory of stocks without enduring the weighty yoke of full investment.

- Synthetic long strategies provide the dual advantage of anchoring our investments against downturns while still participating robustly in upside movements.

- Our approach is elevated by an astute anticipation of market swings, thereby capitalizing on investment opportunities with both prescience and prudence.

| Investment Attribute | Benefit in Synthetic Long Strategy | Comparable Stock Ownership Advantage |

|---|---|---|

| Capital Requirement | Significantly lower to establish position | Substantial capital required for full ownership |

| Profit Potential | Comparable to direct stock ownership | Direct participation in stock value increase |

| Risk Management | Ability to define risk with precision | Risk tied to market value of stock |

In this tableau of financial tactics, it’s evident that the investment benefits conferred by synthetic long strategies are manifold. Not only do we stand to reap the rewards of a bullish market sans the steep entry costs, but we also gain the liberty to adapt our strategies as the ebb and flow of the market dictate. It is these attributes that position synthetic long strategies as a cornerstone in the modern investor’s repertoire.

Synthetic Long Puts vs. Synthetic Long Calls

As we navigate through the intricate world of options trading, it becomes imperative for us to understand the nuanced tactics that form our strategic playbook. In this exploration, we delve into an options strategy comparison, pitting synthetic long puts against synthetic long calls. Each strategy possesses distinctive characteristics catered to particular market outlooks, enabling us to deploy them effectively in alignment with our bullish or bearish anticipations.

We employ synthetic long calls to echo the bullish sentiment, anticipating an escalation in the underlying asset’s price, while we embrace synthetic long puts to express a bearish position, preparing for a potential plummet.

Here, we cast light on each strategy’s framework, dissecting how they offer leverage and risk-defined positions, albeit geared toward divergent market expectations. The artistry of options lies in their malleability, and understanding the variegated tapestry woven by each approach lends us the advantage of versatility in our investment decisions.

| Strategy | Market Outlook | Risk Profile | Anticipated Outcome |

|---|---|---|---|

| Synthetic Long Calls | Bullish | Limited Liability / Unlimited Profit Potential | Profits escalate as stock prices rise |

| Synthetic Long Puts | Bearish | Profit from stock price decline with controlled risk | Benefit from stock price drop while limiting losses |

The synthetic long puts strategy is a stark contrast to its call counterpart, weaving short positions with long calls to create an investment stance prepared for downward trends. Challenging the ascent championed by calls, puts equip us with the tools to gain from the gravitational pull back down to market realism.

Let’s break down the mechanical essence that differentiates these strategies:

- Synthetic Long Calls: We marry at-the-money call options with an equivalent quantity of short puts, constructing a bullish bet on the stock. This confluence is our vote of confidence in the stock’s potential upswing.

- Synthetic Long Puts: A combination of shorting the stock and purchasing at-the-money calls, this is our safety net against a precipitous fall in stock prices. It’s both a protective measure and a calculated wager on declining values.

Our mastery over these options strategies empowers us to craft positions tailored to our market stance. We embrace the power of leverage, a catalyst in amplifying our investment outputs, with the precision of a scalpel to define our risks and, consequently, our potential rewards.

In essence, our adept usage of synthetic long puts and calls illuminates the spectrum of possibilities within the realm of options, allowing us to deploy assets that resonate with our forecasts, be they tinted with optimism or shaded with caution.

Appropriate Market Conditions for Synthetic Long Options

When evaluating the investment strategy adaptation required for successful options trading, it is essential for us to appraise the prevailing market conditions comprehensively. A synthetic long options position, renowned for its minimal sensitivity to shifts in implied volatility, emerges as a vanguard strategy during divergent market scenarios. We recognize, however, the indispensable nature of market volatility analysis in guiding our speculation, as it can significantly affect option pricing and, consequently, our prospective returns.

Volatility Considerations

As we anchor our tactics in the face of market volatility, we turn to specialized options trading indicators that allow us to decode the market’s mercurial patterns. While a synthetic long strategies definitive edge assumes a stoic stance against volatility, it is our collective acumen in anticipating and assimilating these fluctuations that provide us with a more robust scope for investment strategy adaptation.

Identifying Bullish Market Signals

In pursuit of a lucrative yield, we seek to align our strategy with palpable bullish market signals. This quest involves scanning the environment for indicators like robust economic forecasts, promising company earnings projections, and other market analysis insights that collectively suggest an upswing in the asset’s value. Such signals fortify our conjecture that a synthetic long position will likely bask in the auspices of market appreciation.

As arbiters of sophisticated investment strategies, we understand the quintessence of synchronizing our options trades with signals forecasting upward mobility in the market. It’s within this realm of opportunity that our synthetic long positions flourish.

- We scrutinize leading economic reports for signs of market vigor.

- Youthful investor optimism, expressed through analytics and trend data, continuously informs our investment strategy adaptation.

- Our agile response to bullish market signals strengthens our capacity to capitalize on imminent stock appreciation.

| Market Condition | Indicator | Synthetic Long Suitability |

|---|---|---|

| Stable Economic Environment | Earnings Reports, GDP Growth | High |

| Consistent Bullish Trends | Technical Analysis Patterns | Medium to High |

| Elevated Market Volatility | VIX, Beta Measurements | Moderate |

Real-world Applications: When to Implement Synthetic Long Options

As we deepen our foray into the dynamic world of investment, the versatility of synthetic long options stands out for its practical applications in real-world trading scenarios. Traders are increasingly turning to this strategy when they sense a stock’s promising growth trajectory but desire to partake in the ascent without the hefty capital commitment generally associated with outright stock ownership.

Our exploration of **synthetic long options applications** reflects a pragmatic approach to investing, wherein the strategy serves as a more accessible, capital-efficient gateway to potentially lucrative market positions. This alignment of practical trading strategies with market realities emboldens our portfolio with a finesse that can be game-changing.

Embracing synthetic long options is a strategic choice made with the foresight that hefty market implementation costs can be skillfully bypassed without diluting the essence of the investment’s payoff profile.

We’ve distilled the essence of **market implementation** for synthetic long options into situations where they shine as a beacon of strategic investment:

- When diversification calls for capital savings to invest across multiple assets

- In anticipation of stock growth, without the means or desire for direct stock purchase

- To evade capital-intensive requirements, such as margin obligations

This approach is not just theoretically appealing—it has proven its mettle in the trenches of the trading floors, where leveraging capital and yet enjoying stock-like movements is an artful dance.

| Scenario | Without Synthetic Longs | With Synthetic Longs |

|---|---|---|

| Capital Investment Required | Higher due to full stock purchase | Lower due to option premiums only |

| Potential for Stock Gains | Direct participation in full amount | Emulated participation with leveraged control |

| Risk Exposure | Variable with stock performance | Capped at premium with robust upside potential |

In the high-stakes world of investing, we’ve witnessed that the synthetic long options, when judiciously applied, afford traders the elasticity to snugly fit into the contours of varying market conditions. Its adroitness in offering a lower-cost, leverage-inclusive alternative is not just a theoretical concept but a practical solution tested in the waters of market volatility and shifting sentiments.

- Strategic deployment when bullish signals are strong but capital is tight

- Use as a stopgap to swiftly capitalize on short-term growth opportunities

- Application in sectors where direct stock purchase is cost-prohibitive

Forging ahead, we continually seek to refine these synthetic long options applications, ensuring they serve as a cogent ally in the pursuit of strategic investment prowess. Whether we stand at the cusp of a bullish rally or in the shadows of an imminent stock surge, synthetic longs offer us a powerful tool, enabling market participation with sophistication and economic prudence.

Risks and Limitations of Synthetic Long Options

While the synthetic long options strategy offers avenues for potentially lucrative investments with a more palatable capital requirement, our responsibility as prudent investors compels us to scrutinize the risks of synthetic options and limitations of options strategies. A comprehensive investment risk assessment is paramount to understand that while our sights are set on the wins, the potential for losses lurks closely.

To maximize the integrity of our investment decisions, we must weigh the full spectrum of outcomes, including those that challenge our bullish optimism.

Foremost among the concerns is the substantial loss potential should the underlying stock plummet to zero. Unlike holding the actual stock, which allows us to weather the storms of market fluctuations with the potential for recovery, options expire—a hard limit is on our opportunity to recover from downward spirals.

Moreover, our engagement with synthetic long options does not entail the benefits typically enjoyed by stockholders. We forfeit the privileges such as voting rights and the receipt of dividends, a sacrifice we owe to the strategy’s construction.

Intrinsic to the anatomy of synthetic options is the expiration date, a temporal boundary setting the stage for our strategy’s lifespan. This expiration acts as a ceiling to our investment’s profit potential, leading us to maneuver within a fixed window of opportunity, often narrower than we would prefer.

Furthermore, the leveraged nature of synthetic longs means that while the ceiling for profit is high, the floor for losses is dauntingly low. Should the stock endure a descent, the leverage advantage dissipates, potentially leaving us with outsized percentage losses compared to the gains that were within our grasp.

| Risk Factor | Implication | Strategic Consideration |

|---|---|---|

| Stock Falls to Zero | Potential for Total Loss | Assess underlying stock stability |

| Lack of Shareholder Privileges | No Dividends or Voting Rights | Consider importance of ancillary benefits |

| Expiration Date of Options | Limited Profit Window | Strategize around option maturities |

| Leverage Advantages Nullified | Higher Percentage Losses | Prepare for adverse movements |

Through the lens of investment risk assessment, these risks do not necessarily serve as a deterrent but rather as a critical component of our strategic planning. Acknowledging and planning for the limitations of options strategies allows us to steer the course of our investments with eyes wide open to the realities of options trading—a landscape rich with potential yet peppered with pitfalls.

Exit Strategies for Synthetic Long Options Traders

Within the dynamic dance of options trading, adept trade management practices become the backstage choreography that ensures the show is a success. For us, steadfast options traders who harness the power of synthetic long options, articulating our exit strategies is tantamount to fine-tuning the final act of our investment performance. We invoke these strategies not only to lock in profits or mitigate losses but also to navigate the economic stage with the agility and foresight that defines our craft.

Synthetic long options traders typically refrain from riding the trade until expiration because the true art of options lies in the timeliness of an exit. Thus, we harbor a keen focus on exercising exit strategies that allow us to gracefully bow out before the curtain call of expiration dates. This modus operandi prevents the need for a larger capital investment that would ensue if we were to acquire the underlying asset post-assignment, preserving the liquidity that fuels our continued market endeavors.

Our trade exits are choreographed moves—selling the long call and buying back the short put to seal our performance, be it standing ovations in gains or a tactical retreat from losses. Furthermore, let us unfold the layers of this strategy with a structured flow to maximize our well-orchestrated exits.

| Stage of Trade | Action | Purpose | Outcome |

|---|---|---|---|

| Anticipating Gains | Sell Long Call | Realize profits | Capitalize on stock price increase |

| Minimizing Losses | Buy Back Short Put | Prevent further losses | Avert requirement to purchase stock at strike price |

| Market Sentiment Shift | Adjust Positions | Alignment with new market outlook | Reposition to potentially beneficial stance |

| Approaching Expiration | Intentional Exit | Avoid assignment and ownership | Preserve capital for future trades |

We, as seasoned options traders, understand the pivotal role of timely exits and adhere to exit strategies like an orchestra keeps time with the conductor’s baton.

- If the market favors our predictions, we seize the moment, selling high to harness the fruit of our foresight.

- Should the winds of change blow in less favorable conditions, we muster resilience by exiting with poise, minimizing our losses.

- In the fluidity of trade markets, being adaptable ensures we are never static, always positioning for the next opportune moment.

As custodians of our portfolio, we extend beyond the mere act of choosing when to exit; we embody the essence of trade exit strategies as an integral part of our ongoing saga in the financial markets. These strategies constitute the silent but strong framework upon which we build our success narrative within the options trading realm.

The elucidation of our exit strategies reveals a path for other options traders to emulate, sowing the seeds for the collective elevation of our trade practices. We commit to a doctrine of disciplined exits, ensuring we transition our trades from potential to actualized achievements or measured concessions, all orchestrated with the precision and acumen that sets apart the truly proficient practitioners of the options trading world.

Conclusion

In this synthesis of options trading wisdom, we have meticulously unraveled the synthetic long options strategy, casting light upon its role as a strategic linchpin in our arsenal of investing tools. A linchpin noted for its capability to adeptly imitate outright stock ownership while mercifully sparing us the burden of heavy capital deployment. As we pull back to the strategic investment wrap-up, it’s clear that the synthetic long options strategy stands as the embodiment of financial agility, granting us the advantage of high-profit potential tethered with protective risk measures. Our odyssey through the mechanics of this strategy underscores the essence of strategic investing—it is both an art and a science.

This options trading summary would be incomplete without a nod to the very real considerations of risk that accompany synthetic longs. Acknowledging such risks are as crucial as recognizing the opportunities, thus ensuring that our decisions are informed and our strategies resilient. In the concert of the financial markets, the synthetic long options strategy is a complex solo that, when played with skill under the right market conditions, resounds with the potential to enrich our financial portfolio with both melody and harmony.

Our engagement with the synthetic long options strategy conclusion is not merely the end of a chapter but part of an enduring narrative in prudent financial stewardship. We remain vigilant and adaptive, ever prepared to deftly employ this strategy as a powerful adjunct in our investment narrative. It is through such strategic instrumentality that we carve a path of financial opportunity, echoing our perennial quest to capture the bullish spirits of the market while standing mindful of the risks at our flank.

FAQ

What is a synthetic long options strategy?

A synthetic long options strategy is a financial strategy that involves buying a call option and selling a put option with the same strike price and expiration date. This technique is designed to mimic the return profile of owning stock, allowing investors to profit if the stock price rises and effectively own the stock at the strike price if it falls below. This strategy offers a similar profit potential to stock ownership without requiring the full capital outlay of purchasing the shares, along with downside risk protection.

How does a synthetic stock position work in options trading?

A synthetic stock position in options trading is created by combining options to emulate the payoff of a long stock position. This is achieved by purchasing at-the-money call options while simultaneously selling at-the-money put options with the same expiration date and strike price. The call option provides the potential for unlimited gains if the stock price increases, while the sold put option sets a floor, limiting the downside risk.

What are the roles of call and put options in a synthetic long position?

In a synthetic long position, call options grant investors the potential for unlimited profit if the underlying stock price increases. This aligns with a bullish market outlook. Put options, when sold in this strategy, help finance the purchase of the long calls and establish a limit on the potential losses, providing downside risk protection. Together, they effectively create a position that behaves like a long stock position with exposure to upward price movements.

How are the strike price and expiration date important in a synthetic long strategy?

The strike price and expiration date are crucial in a synthetic long strategy because they ensure that the call and put options work together to accurately simulate a stock position. The options must have the same strike price and expiration date to maintain a balanced position and manage the trade effectively, whether the goal is capital appreciation or hedging against potential downturns.

How do you calculate the break-even point of a synthetic long position?

The break-even point of a synthetic long position depends on whether the position was entered for a credit or a debit. If entered for a credit, subtract the premium received from the strike price to find the break-even. If the position was taken for a debit, the break-even is calculated by adding the premium paid to the strike price. This calculation helps investors understand the price at which their synthetic long position neither makes nor loses money, excluding transaction costs.

What is the maximum profit and loss potential in a synthetic long options strategy?

The maximum profit potential in a synthetic long options strategy is theoretically unlimited, as it is tied to the stock’s price appreciation. The maximum loss, however, is principled down to zero, as the losses would accumulate with the stock price declining. Therefore, while the profit potential with a synthetic long strategy is substantial, it’s crucial to be aware of the risk exposure, especially if the stock price plummets.

What are the strategic advantages of a synthetic long strategy?

The strategic advantages of a synthetic long strategy include the potential for unlimited profit similar to owning the actual stock, lower capital requirement to establish the position, and the use of leverage to enhance returns. It allows investors to define risk and reward objectives and benefit from bullish market movements without needing the full capital outlay or the desire for shareholder privileges.

How do synthetic long puts differ from synthetic long calls?

Synthetic long puts are used in anticipation of a stock’s price decline and typically involve shorting the stock coupled with buying call options, reflecting a bearish strategy. In contrast, synthetic long calls are bullish strategies expecting a price increase, consisting of buying call options and selling put options. Both strategies can offer leverage and defined-risk positions, but they are used in different market outlooks.

When is it appropriate to implement a synthetic long options strategy?

It is appropriate to implement a synthetic long options strategy when bullish market conditions are anticipated, which may include positive economic indicators, strong company earnings, or other signals suggesting that the stock’s price is likely to rise. The strategy thrives when the market’s outlook aligns with capitalizing on upward price movements, combined with an investor’s risk tolerance and strategic investment goals.

What are the risks and limitations associated with a synthetic long strategy?

The risks and limitations of a synthetic long strategy include the potential for significant losses if the stock price drops to zero, and the absence of shareholder benefits like dividends and voting rights. Additionally, the strategy has a time constraint due to the options’ expiration date, which may limit the profitability window. The synthetic position also loses its leverage advantage if the underlying stock declines sharply.

What exit strategies should synthetic long options traders consider?

Synthetic long options traders might consider exiting their position prior to expiration to realize gains or minimize losses. The exit strategy typically involves selling the long call and buying back the short put. This enables the trader to close the position without the requirement for a larger capital investment that would be necessary for acquiring the stock upon option assignment.