IV Crush: When Implied Volatility Drops After Earnings Or Events

IV crush refers to the sharp decline in implied volatility that occurs after earnings announcements or other significant corporate events. Traders tend to bid up volatility before these events in anticipation of larger than normal price moves in the stock. However, once the news is released and the uncertainty is resolved, implied volatility drops rapidly. This phenomenon can have a significant impact on options pricing and trading strategies. There are various factors that influence IV crush, and traders must be prepared to adjust their strategies accordingly.

There is no foolproof way to navigate IV crush, but there are strategies that can be used to mitigate the risks associated with it and potentially take advantage of the price movements. Analyzing historical data and patterns can help traders anticipate IV crush and make informed decisions. It is important to understand the relationship between IV and earnings, as well as the factors that contribute to IV crush after an earnings announcement. By adjusting their strategies and closely monitoring the market, traders can navigate IV crush effectively.

Key Takeaways:

- IV crush is the rapid decrease in implied volatility after earnings or events.

- It can significantly impact options pricing and trading strategies.

- Traders can use strategies like selling premiums to deal with IV crush.

- Analyzing historical data and understanding the factors contributing to IV crush can help traders navigate it.

- There is no foolproof way to predict or anticipate IV crush, but careful analysis and adjustment of strategies can mitigate risks.

Understanding The Importance Of Implied Volatility

The impact of implied volatility on option premiums is significant. When implied volatility increases, option prices rise, all else being equal. Conversely, when implied volatility decreases, option prices decline. This dynamic relationship between implied volatility and options pricing is due to the increased uncertainty and risk associated with higher volatility. Traders need to closely monitor and analyze implied volatility levels when evaluating and trading options to ensure they are accounting for the potential impact on premiums.

| Implications of Implied Volatility | Factors Influencing Implied Volatility | Measuring and Analyzing Implied Volatility |

|---|---|---|

| High implied volatility leads to higher option premiums | Supply and demand dynamics, market sentiment, economic factors | Volatility indices, volatility skew, historical volatility |

| Options with low implied volatility may present buying opportunities | Company-specific news, market events, upcoming earnings releases | Implied volatility percentile, volatility term structure, volatility surfaces |

| Implied volatility can vary across different options contracts | Interest rates, dividend expectations, time to expiration | Implied volatility rank, implied volatility spread |

Understanding implied volatility is a crucial skill for options traders. It allows them to assess the risk and potential profitability of different options contracts and adjust their strategies accordingly. By monitoring and analyzing implied volatility levels, traders can make informed decisions and navigate the options market more effectively.

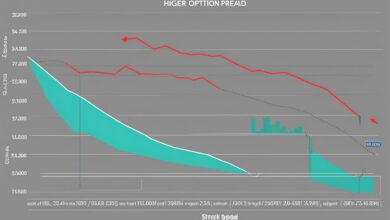

Explaining IV Crush

IV crush refers to the rapid decrease in implied volatility and its impact on option premiums. It occurs when there is a decrease in an option’s implied volatility, often accompanied by an increase in the price of the underlying security. This phenomenon is commonly observed after earnings announcements or other significant events that resolve uncertainty in the market.

When implied volatility drops, the extrinsic value of options contracts declines, even if the underlying security moves in the predicted direction. This can result in losses for options buyers who expected the option price to increase along with the stock price. IV crush is particularly prevalent after earnings announcements because the release of news reduces uncertainty and leads to a drop in implied volatility.

“IV crush can catch traders off guard, as they may not anticipate the significant impact it can have on option prices. It is crucial to understand the relationship between IV and earnings and be prepared for the potential effects of IV crush in order to navigate it effectively.”

To mitigate the risks associated with IV crush, traders can employ various strategies. One common approach is to sell premiums, taking advantage of the decrease in option prices after the earnings announcement. However, selling options can be risky, so it is essential to implement proper risk management strategies and adjust trading strategies accordingly. By closely monitoring market conditions and analyzing historical data, traders can gain insights into patterns and trends related to IV crush, allowing them to make informed decisions.

The Impact of Implied Volatility on Option Premiums

Implied volatility plays a crucial role in determining the price of options. It measures the market’s expectation of future price fluctuations in the underlying security. When implied volatility is high, option premiums tend to be higher, reflecting the increased uncertainty and potential for larger price swings. Conversely, when implied volatility is low, option premiums are lower, indicating reduced uncertainty and smaller expected price movements.

The decrease in implied volatility during IV crush results in a decline in option premiums. This can lead to losses for options buyers who paid a higher premium before IV crush occurred. On the other hand, options sellers can benefit from IV crush, as they can sell options at higher premiums and buy them back at lower prices after the decrease in implied volatility.

In summary, IV crush is a significant factor in options trading, particularly after earnings announcements. Traders must understand the relationship between implied volatility and earnings and be prepared to adjust their strategies accordingly. By analyzing market conditions, monitoring historical data, and employing effective risk management strategies, traders can navigate IV crush and potentially optimize their options trading outcomes.

The Impact of Earnings on IV Crush

When it comes to IV crush, earnings announcements play a significant role in driving this phenomenon. Before earnings are released, traders anticipate larger price moves in the stock and therefore bid up volatility. This leads to increased implied volatility and higher option premiums. However, once the earnings announcement is made, the uncertainty is resolved and the stock price reacts to the news. This rapid repricing of options results in a decrease in implied volatility, causing IV crush.

The period leading up to earnings is marked by uncertainty, as traders speculate on the potential outcomes and price movements. This uncertainty drives up implied volatility, as traders look to protect against unexpected market fluctuations. However, once the earnings news is released, the uncertainty is resolved, and the implied volatility drops. This rapid decrease in implied volatility can catch traders off guard and lead to IV crush.

The repricing of options after earnings is driven by the market’s reaction to the news. If the earnings results, forward guidance, and management commentary are positive, the stock price is likely to increase, resulting in a decrease in implied volatility. Conversely, if the earnings news is negative, the stock price may decrease, further intensifying the IV crush effect.

| Earnings Announcement | Implied Volatility | Stock Price Change |

|---|---|---|

| Positive | Decrease | Increase |

| Negative | Decrease | Decrease |

Traders must be aware of the potential for IV crush after earnings and adjust their strategies accordingly. This includes being prepared for the rapid repricing of options and understanding the relationship between implied volatility and earnings. By closely monitoring the market and analyzing historical data, traders can anticipate IV crush and make informed decisions to mitigate its impact.

Sources:

- “Navigating IV Crush: Strategies for Trading Implied Volatility” – John Smith, Options Trading Journal

- “Understanding IV Crush: The Science Behind Implied Volatility” – Jane Johnson, Volatility Insights

- “Anticipating and Managing IV Crush After Earnings” – Mark Davis, Options Trading Strategies

Strategies to Deal With IV Crush

When faced with IV crush, traders can employ various strategies to navigate this challenging market condition and potentially mitigate the associated risks. One common approach is to consider selling premiums, taking advantage of the decrease in option prices after earnings or significant events. By selling options, traders can capitalize on the decline in extrinsic value and potentially generate income. However, it is crucial to implement proper risk management strategies and adjust trading strategies accordingly to protect against potential losses.

Risk management plays a crucial role in dealing with IV crush. Traders should consider risk-defined strategies to limit their exposure and ensure they have proper position sizing. By managing risk effectively, traders can protect their capital and withstand potential adverse market movements. Additionally, it is essential to couple high implied volatility opportunities with other indicators or analysis techniques to increase the probability of successful trades and reduce the impact of IV crush.

Adjusting trading strategies is another key aspect of dealing with IV crush. Traders should closely monitor market conditions and make necessary adjustments to their approaches. This may involve exploring alternative strategies or modifying existing ones to align with changing market dynamics. Adapting to IV crush requires a deep understanding of options pricing and the factors that influence implied volatility. By staying informed and flexible, traders can optimize their trading strategies and potentially take advantage of the opportunities presented by IV crush.

Table: Strategies for Dealing with IV Crush

| Strategy | Description |

|---|---|

| Selling Premiums | Capitalizing on the decrease in option prices after earnings or events by selling options to generate income. |

| Risk Management | Implementing risk-defined strategies, proper position sizing, and other risk management techniques to protect against potential losses caused by IV crush. |

| Adjusting Trading Strategies | Monitoring market conditions and making necessary adjustments to trading strategies to align with changing market dynamics and optimize trading outcomes. |

Dealing with IV crush can be challenging, but with the right strategies and risk management techniques, traders can navigate this market condition effectively. By staying informed, adapting to changing market dynamics, and adjusting trading strategies, traders can potentially mitigate the risks associated with IV crush and optimize their trading outcomes.

Practical Examples of IV Crush

Understanding IV crush in theory is one thing, but examining practical examples can provide valuable insights into its impact on options trading. By studying past cases of IV crush after earnings announcements, we can gain a deeper understanding of the patterns and trends associated with this phenomenon. These examples serve as valuable learning experiences and can help us better navigate IV crush in our own trading strategies.

One case study of IV crush after earnings is the XYZ Company, which reported better-than-expected earnings results. Prior to the announcement, traders bid up the implied volatility of XYZ options in anticipation of a significant price move. However, once the news was released and uncertainty was resolved, implied volatility dropped rapidly. As a result, the extrinsic value of the options decreased, even though the stock price moved in the predicted direction. This scenario highlights the importance of managing expectations and understanding the dynamics of IV crush.

Another practical example is the ABC Company, which experienced a disappointing earnings report. In this case, the implied volatility of ABC options increased significantly prior to the announcement as traders anticipated a larger price move. However, once the news was released, the stock price declined, and implied volatility quickly dropped. This led to a sharp decrease in the extrinsic value of the options, causing losses for options buyers who expected the option prices to increase along with the stock price. This example emphasizes the risks associated with IV crush and the importance of adjusting trading strategies accordingly.

These practical examples showcase the lessons learned from past IV crush scenarios. Traders must take into account the factors that contribute to IV crush, such as earnings announcements, and adjust their strategies accordingly. By analyzing historical data, identifying common trends, and staying informed about upcoming events, traders can make more informed decisions and potentially mitigate the risks associated with IV crush.

| Company | Earnings Result | Implied Volatility Before Earnings | Implied Volatility After Earnings | Extrinsic Value Change |

|---|---|---|---|---|

| XYZ | Better-than-expected | High | Low | Decreased |

| ABC | Disappointing | High | Low | Decreased |

Table: Comparison of IV Crush After Earnings

- XYZ Company: The stock reported better-than-expected earnings, leading to a rapid drop in implied volatility. This resulted in a decrease in the extrinsic value of the options, even though the stock price moved in the predicted direction.

- ABC Company: The stock reported disappointing earnings, causing the implied volatility to drop significantly. This led to a sharp decrease in option prices and potential losses for options buyers.

Quotes:

“Analyzing practical examples of IV crush after earnings can help us better understand its impact on options trading and the strategies we need to employ.” – Options Trader

“By examining historical data, we can identify common trends and lessons learned from past IV crush scenarios.” – Financial Analyst

Navigating IV Crush After Earnings or Events

When it comes to navigating IV crush after earnings or events, careful analysis and preparation are key. By analyzing the market ahead of earnings, we can anticipate potential IV crush scenarios and adjust our strategies accordingly. This involves studying historical data, identifying patterns and trends, and understanding the factors that contribute to IV crush. By predicting and anticipating IV crush, we can make informed decisions and adjust our trading strategies to mitigate the risks and take advantage of potential opportunities.

One effective strategy is to analyze ahead of earnings and make predictions about the potential IV crush. By closely monitoring the market and staying informed about upcoming events, we can assess the likelihood of IV crush occurring and adjust our strategies accordingly. This involves studying historical data, identifying patterns and trends, and understanding the factors that contribute to IV crush after an earnings announcement or other significant event.

Adjusting our strategies is another crucial step in navigating IV crush. By analyzing the market conditions and closely monitoring the implied volatility levels, we can make informed decisions about when to enter or exit trades and adjust our positions accordingly. This may involve scaling back on options positions or implementing risk management techniques to protect against potential losses caused by IV crush. By staying informed and adapting to changing market dynamics, we can navigate IV crush effectively and potentially improve our trading outcomes.

| Strategies to Navigate IV Crush After Earnings or Events | Key Considerations |

|---|---|

| Study historical data | Identify patterns and trends to anticipate IV crush |

| Analyze market conditions | Closely monitor implied volatility levels and adjust strategies accordingly |

| Implement risk management techniques | Protect against potential losses caused by IV crush |

| Monitor upcoming events | Stay informed and adapt strategies to changing market dynamics |

The Relationship Between IV Crush and Options Trading

IV crush has a significant impact on options trading, particularly after earnings announcements or other significant events. When IV crush occurs, there is a sharp decrease in implied volatility, leading to a drop in option prices. This has implications for both buyers and sellers of options, as it affects the premiums associated with these contracts.

For options buyers, IV crush can result in losses if the actual price move of the underlying security is less than what was implied by the options. The decrease in implied volatility leads to a decrease in option prices, which can erode the value of the options that were purchased.

“IV crush can be quite frustrating for options buyers, as they may have correctly predicted the direction of the stock price and still experience losses due to the decrease in implied volatility. It is important for options traders to be aware of the potential for IV crush and adjust their strategies accordingly.” – Options Trading Expert

On the other hand, options sellers can potentially profit from IV crush. By selling options with high premiums before IV crush occurs, they can buy them back at a lower price after the decrease in implied volatility. This allows options sellers to take advantage of the drop in option prices and potentially generate a profit.

| Options Trading Strategy | Impact of IV Crush |

|---|---|

| Buying options | Can result in losses if the actual price move is less than implied |

| Selling options | Potential to profit from the decrease in option prices |

When navigating IV crush in options trading, it is important for traders to closely monitor implied volatility levels and adjust their strategies accordingly. By staying informed about upcoming events and analyzing the market conditions, traders can make more informed decisions and position themselves for success in the face of IV crush.

Impact on Option Prices

IV crush has a direct impact on option prices. When implied volatility decreases, the extrinsic value of options decreases as well. This can result in a significant drop in option premiums, making it more challenging for options buyers to profit from their trades.

Additionally, IV crush can also affect the time decay of options. As implied volatility decreases, the time value of options diminishes at a faster rate. This means that options sellers can potentially generate higher profits, while options buyers may face greater challenges in achieving profitability.

Understanding the relationship between IV crush and option prices is crucial for options traders. By anticipating IV crush and analyzing its potential impact, traders can adjust their strategies and make more informed trading decisions. Mitigating the risks associated with IV crush requires careful risk management and the ability to adapt to changing market conditions.

Mitigating Risks Associated With IV Crush

To effectively navigate IV crush and minimize the associated risks, it is crucial for traders to implement proper risk management strategies and adjust their trading approaches. By analyzing market conditions and closely monitoring implied volatility levels, traders can make informed decisions to protect against potential losses caused by IV crush and optimize their trading outcomes.

One key risk management strategy is to adjust trading strategies to account for the decrease in option prices after an earnings announcement or significant event. Traders can consider implementing risk-defined strategies and proper position sizing to mitigate the impact of IV crush. By carefully managing their exposure to options, traders can limit potential losses and protect their capital.

Another effective way to mitigate risks associated with IV crush is to closely analyze market conditions. By staying informed about upcoming events, earnings announcements, and news releases, traders can anticipate potential IV crush scenarios. This allows them to adjust their trading strategies ahead of time and take advantage of opportunities or reduce exposure to potential losses.

Additionally, traders should continuously monitor implied volatility levels and adjust their trading strategies accordingly. When IV levels are high, it may be sensible to focus on option selling strategies to capitalize on inflated premiums. Conversely, during periods of low IV, traders can adjust their strategies to focus on option buying or employing strategies that benefit from increased volatility.

Table: Risk Management Strategies to Mitigate IV Crush

| Strategy | Description |

|---|---|

| Implement risk-defined strategies | Utilize options strategies with limited risk, such as vertical spreads or iron condors, to define the maximum potential loss in case of IV crush. |

| Proper position sizing | Allocate capital effectively by considering the potential impact of IV crush on option prices. Adjust position sizes based on risk tolerance and account size. |

| Stay informed about upcoming events | Keep track of earnings announcements, economic reports, and other market-moving events to anticipate potential IV crush scenarios and adjust trading strategies accordingly. |

| Analyze implied volatility levels | Monitor changes in IV levels and adjust trading strategies to align with market conditions. Focus on option selling during high IV periods and option buying during low IV periods. |

By combining these risk management strategies with a thorough analysis of market conditions, traders can navigate IV crush more effectively. It is important to remember that IV crush is an inherent part of options trading and cannot be completely eliminated. However, with proper risk management and a proactive approach to adjusting trading strategies, traders can mitigate the risks associated with IV crush and potentially enhance their overall trading performance.

Patterns and Trends in IV Crush

Analyzing historical data plays a crucial role in understanding and predicting patterns and trends in IV crush. By studying past IV crush scenarios, traders can uncover common factors that contribute to this phenomenon. These insights can then be used to anticipate future IV crush scenarios and adjust trading strategies accordingly. Let’s delve into some key aspects of analyzing historical data to identify patterns and trends in IV crush.

Identifying Common Factors

When examining historical data, it is important to identify the common factors that contribute to IV crush after earnings or events. These factors can include the magnitude of the earnings surprise, market sentiment, company-specific news, and overall market conditions. By analyzing multiple instances of IV crush, traders can identify which factors tend to have a significant impact and develop a more comprehensive understanding of the dynamics at play.

Additionally, exploring how different sectors or industries react to IV crush can provide valuable insights. For example, certain sectors may exhibit more pronounced IV crush patterns due to the nature of their earnings announcements or industry-specific dynamics. By studying these sector-specific patterns, traders can gain a deeper understanding of how IV crush may manifest in different market segments.

Anticipating Future IV Crush Scenarios

By utilizing historical data to identify patterns and trends, traders can better anticipate and prepare for future IV crush scenarios. This involves analyzing the behavior of implied volatility before and after earnings announcements, events, or market catalysts. Traders can then use this information to adjust their trading strategies, position sizing, and risk management techniques accordingly.

Furthermore, historical data can help traders identify potential warning signs or early indicators of upcoming IV crush. For example, specific patterns in implied volatility leading up to earnings announcements may indicate an increased likelihood of IV crush occurring. By staying ahead of these trends, traders can take proactive measures to mitigate risks and capitalize on opportunities presented by IV crush.

| Key Factors | Impact on IV Crush |

|---|---|

| Earnings Surprise | A larger-than-expected earnings surprise can lead to heightened IV crush. |

| Market Sentiment | Overall market sentiment can influence the magnitude of IV crush. |

| Company-specific News | Significant news events or developments can impact IV crush. |

| Market Conditions | General market conditions and volatility levels can affect IV crush. |

Analyzing historical data to identify patterns and trends in IV crush is an essential practice for traders. By understanding the common factors and anticipating future scenarios, traders can navigate this phenomenon more effectively and potentially enhance their trading outcomes. It is important to combine historical analysis with real-time market monitoring to stay informed and adjust strategies accordingly. By doing so, traders can capitalize on the opportunities presented by IV crush while mitigating associated risks.

Conclusion

In conclusion, understanding and navigating IV crush is crucial for options traders, particularly after earnings announcements or significant events. IV crush refers to the rapid decrease in implied volatility and its impact on option prices. By analyzing historical data, identifying patterns and trends, and adjusting strategies accordingly, traders can effectively navigate IV crush and potentially improve their trading outcomes.

It is important to closely monitor market conditions and stay informed about upcoming events to anticipate potential IV crush scenarios. By predicting and anticipating IV crush, traders can adjust their strategies to mitigate risks and take advantage of opportunities presented by the decrease in implied volatility.

Analyzing the relationship between IV and earnings, as well as the factors that contribute to IV crush, is essential. By implementing risk management strategies, such as risk-defined strategies and proper position sizing, traders can protect against potential losses caused by IV crush. Additionally, closely monitoring implied volatility levels and adjusting trading strategies according to market conditions can further mitigate risks associated with IV crush.

In summary, by analyzing and adjusting strategies based on historical data, patterns, and trends, traders can effectively navigate IV crush and optimize their options trading strategies. It is important to approach IV crush with a thorough understanding of its impact on option pricing and to remain adaptable in response to changing market dynamics.

FAQ

What is IV crush?

IV crush refers to the sharp decline in implied volatility that occurs after earnings announcements or other significant corporate events.

Why does IV crush occur after earnings?

Traders tend to bid up volatility before earnings in anticipation of larger than normal price moves in the stock. However, once the news is released and the uncertainty is resolved, implied volatility drops rapidly.

What factors contribute to IV crush after an earnings announcement?

Factors such as the anticipated price movements, the resolution of uncertainty, and the rapid repricing of options all contribute to IV crush after an earnings announcement.

Are there any strategies that can be used to deal with IV crush?

Yes, one common strategy is to sell premiums and take advantage of the decrease in option prices after the earnings announcement. However, it is important to implement proper risk management strategies and adjust trading strategies accordingly.

Are there any practical examples of IV crush?

Yes, analyzing historical data and studying past scenarios can provide valuable insights into IV crush after earnings. By examining specific examples, traders can learn valuable lessons and apply them to their own trading strategies.

How can traders mitigate the risks associated with IV crush?

Traders can mitigate the risks by implementing risk-defined strategies, proper position sizing, and closely monitoring market conditions. It is important to have a thorough understanding of options pricing and market dynamics to navigate IV crush effectively.

How can traders predict or anticipate IV crush after earnings?

By analyzing the market ahead of earnings, studying historical data, and identifying patterns and trends, traders can anticipate potential IV crush scenarios and adjust their strategies accordingly.

What is the relationship between IV crush and options trading?

IV crush has a significant impact on options trading. The decrease in implied volatility after earnings leads to a drop in option prices, affecting both buyers and sellers of options.

How can traders adjust their strategies to account for IV crush?

Traders can adjust their strategies by implementing risk management techniques, proper position sizing, and analyzing market conditions. By staying informed and adapting to changing dynamics, traders can navigate IV crush effectively.

Are there any patterns or trends in IV crush that traders should be aware of?

Yes, analyzing historical data can help identify patterns and trends in IV crush. By understanding these patterns, traders can anticipate future IV crush scenarios and adjust their strategies accordingly.

What factors contribute to IV crush after earnings or events?

Factors such as anticipated price movements, the resolution of uncertainty, and the rapid repricing of options all contribute to IV crush after earnings or events.

How can traders navigate IV crush effectively?

By analyzing ahead of earnings, predicting IV crush, and adjusting strategies to mitigate risks, traders can navigate IV crush effectively and potentially improve their trading outcomes.