Options Straddle vs Strangle: Key Differences

Options trading presents a myriad of strategies for investors looking to capitalize on stock price movements. Among these, straddles and strangles stand out for their ability to harness significant volatility. Both strategies offer unique advantages and cater to different market predictions. This article aims to clarify these strategies, highlighting their key differences and appropriate usage scenarios.

Demystifying the Straddle

A straddle involves simultaneously buying a call and put option with:

- Identical strike prices

- The same expiration date

The core objective of a straddle is to profit from substantial stock price shifts without the need to forecast the direction of the movement. Traders often employ this strategy in anticipation of major events like earnings announcements or product launches, which could lead to significant price fluctuations.

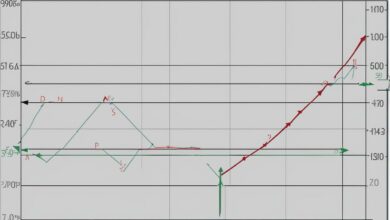

Straddle in Action

Consider a stock priced at $50. By purchasing both a $50 call and a $50 put, a trader positions themselves to profit if the stock undergoes a considerable rise or fall from this price point.

Exploring the Strangle

A strangle shares similarities with a straddle but differs in key aspects:

- The call and put options have varying strike prices

- They maintain the same expiration date

Strangles often involve out-of-the-money (OTM) options, making them generally more affordable than straddles. This strategy is apt for traders who expect a large stock price movement but are looking to minimize initial investment costs.

Strangle Example

For a stock trading at $70, a trader might opt for a $68 put and a $72 call. This approach is less costly, though it requires a more significant stock movement to yield profit.

Straddle vs. Strangle: A Comparative Overview

| Criteria | Straddle | Strangle |

|---|---|---|

| Strike Prices | Same for call and put | Different for call and put |

| Cost | Higher (at-the-money options) | Lower (out-of-the-money options) |

| Break-even Point | Requires less stock movement | Requires more stock movement |

| Risk Profile | Higher initial investment | Lower upfront cost but needs larger movement |

Strategic Applications

- Opt for a Straddle when:

- High volatility is anticipated.

- Direction-agnostic profit is desired.

- Higher upfront costs are acceptable for potentially larger returns.

- Choose a Strangle when:

- Significant stock price shifts are expected, but cost-efficiency is a priority.

- Larger stock movements for profitability are acceptable.

Risks and Key Considerations

It’s important to note that both strategies entail risks. Straddles demand a substantial price movement to offset higher premiums, while strangles can lead to total losses if the stock fails to move sufficiently to make either option profitable.

Advantages of Straddles

Straddles are a valuable strategy for investors faced with uncertainty about the direction of a stock price. By simultaneously purchasing both a call and a put option, straddles provide protection regardless of the outcome. This versatile strategy allows investors to profit from significant price moves in either direction, reducing the risk of choosing the wrong bet on the stock’s future movement.

Benefits of Straddles:

1. Protection: Straddles protect investors from uncertain outcomes by combining the purchase of both call and put options. This strategy ensures that regardless of whether the stock price goes up or down, the investor has positions that will be profitable.

2. Flexibility: Straddles offer flexibility because they allow investors to profit from significant price moves in either direction. This is especially beneficial when there is uncertainty surrounding the stock’s future movement. Instead of taking a position and guessing the stock’s movement, a straddle allows investors to benefit from price volatility.

3. Reduced Risk: By utilizing a straddle strategy, investors can mitigate the risk of making the wrong bet on the stock’s future movement. Since straddles involve both long call and long put options, any potential losses from one side can be offset by gains from the other side, reducing overall risk.

“Straddles provide investors with protection and flexibility when faced with uncertainty about a stock’s price movement.” – [insert expert’s name], [insert job title]

A Comparison of Straddles and Strangles

In comparison to strangles, which have different strike prices for their call and put options, straddles have a common strike price. This means that straddles have a higher cost of entry compared to strangles. However, the benefits of protection, flexibility, and reduced risk make straddles a popular choice for investors navigating uncertainty in the stock market.

| Advantages of Straddles | Advantages of Strangles | |

|---|---|---|

| Protection | Provide protection regardless of stock price outcome | Offer protection against downside risk |

| Flexibility | Profit from significant price moves in either direction | Profit from stock movement in a specific direction |

| Risk Reduction | Mitigate risk by offsetting losses from call or put options | Reduce cost of entry and potentially higher return on investment |

Overall, straddles provide investors with a comprehensive strategy that combines protection, flexibility, and risk reduction. While strangles may offer a lower cost of entry and the potential for higher returns, straddles are advantageous in uncertain market conditions where protection and flexibility are of primary importance. By understanding the advantages of straddles, investors can make informed decisions about their options trading strategies.

Advantages of Strangles

When it comes to navigating stock movement with protection, strangles are a valuable strategy for investors. Strangles allow investors to capitalize on a positive announcement while still safeguarding against a negative move in a stock. By purchasing an out-of-the-money call option and an out-of-the-money put option, investors can benefit from the anticipated movement in a stock’s price while having the security of downside protection.

One major advantage of strangles is their cost-effectiveness. Unlike straddles, which involve options with a common strike price, strangles utilize out-of-the-money options. These out-of-the-money options typically have a lower premium compared to at-the-money or in-the-money options, making strangles a more affordable trading strategy.

Overall, strangles provide investors with the flexibility to profit from expected stock movement while minimizing risk. Whether a positive or negative outcome arises, investors are well-positioned to capture opportunities and protect their investments.

Consider the following example to illustrate the advantages of strangles:

Investor A believes that ABC Corp. is about to make a significant announcement that will likely cause its stock to soar. However, Investor A is also aware that an unforeseen negative event in the broader market could lead to a decline in ABC Corp.’s stock. To hedge against potential losses, Investor A decides to implement a strangle strategy.

Investor A purchases an out-of-the-money call option with a strike price above the current stock price and an out-of-the-money put option with a strike price below the current stock price. This strategy allows Investor A to participate in any positive movement resulting from the anticipated announcement while still having protection if the stock price unexpectedly drops.

With strangles, investors can navigate the complexities of stock market movements and effectively manage risk in a cost-effective manner.

Table

| Advantages of Strangles |

|---|

| Allows investors to benefit from positive announcements |

| Provides downside protection |

| Cost-effective compared to straddles |

| Flexibility to profit from expected stock movement |

Price Movements and Profitability: Straddle vs Strangle Insights

Understanding how price movement impacts straddle and strangle options strategies is crucial in evaluating the profitability scenarios for both. The flexibility of advanced options strategies in tight-range price movements becomes evident as we explore the key differences between straddle and strangle options in response to price movements. This provides insights into how underlying stock price movement affects straddle and strangle strategies, offering a perspective on the profit potential of straddle and strangle options in different market scenarios.

How Price Movement Affects Straddle and Strangle

When evaluating options strategies, it’s crucial to analyze how price movement impacts long and short straddle strategies. Understanding the influence of price movement on long and short strangle options strategies is equally important. Exploring potential income and risk tolerance in both straddle and strangle options provides valuable insights into high-risk, advanced options strategies. Evaluating the risk and potential income of these strategies based on price movement is essential for informed decision-making.

Profitability Scenarios for both Straddle and Strangle

Exploring the profit potential and maximum risk in long options and long strategies, along with analyzing the potential income and maximum profit in short strategies, provides valuable insights into NLP terms such as money call and money options. Assessing risk and profit potential in different market conditions allows for a comprehensive understanding of high-risk strategies. Understanding how underlying price movement and time decay influence profitability adds depth to straddle and strangle strategies. Earnings release and product launch further impact profit scenarios.

Cost Implications: Evaluating Straddle and Strangle

Evaluating the cost implications of options strategies is crucial in options trading. Both long and short straddle strategies have varying total costs and transaction costs. Similarly, long and short strangle options strategies differ in their cost efficiency and risk tolerance. Analyzing these differences helps in understanding the potential income and associated risk of each strategy, allowing traders to make informed decisions based on their investment objectives and risk appetite.

Cost Analysis: Straddle

When considering the cost analysis of long straddle options in options trading, it’s important to explore the lower cost and greater risk associated with this strategy. Understanding the specific date and expiration date implications is crucial, as well as analyzing the cost and flexibility in response to underlying asset movement. Additionally, it’s valuable to learn about iron condor and iron butterfly strategies as cost-effective alternatives, all while considering investment advice and risk tolerance. These factors play a significant role in effective money options and long strategies.

Cost Considerations: Strangle

When considering long strangle strategies in options trading, it’s essential to understand the cost implications and flexibility. Assessing potential income and risk tolerance in various market conditions is crucial. Analyzing transaction costs and trade tab implications provides insight into the overall investment strategy. Evaluating the total cost and profit potential of long strangle options ensures informed decision-making. It’s important to carefully weigh the cost considerations against the profit potential while considering high-risk scenarios.

Choosing Between Straddle and Strangle

Factors such as risk tolerance, market conditions, and cost implications heavily influence the decision between straddle and strangle options strategies. Understanding the differences in maximum risk and profit potential is crucial for informed decision-making. It’s essential to analyze the cost implications and seek investment advice before choosing a strategy. Evaluating different strike prices and considering underlying market conditions also play a significant role in making the right choice. Furthermore, assessing potential income and risk tolerance is vital in determining the most suitable strategy.

Factors Influencing the Choice

When choosing between straddle and strangle options, factors such as underlying security and market implications should be explored. Understanding the key differences and considering risk tolerance is crucial. The percentile indicator and expiration date play a significant role in decision-making. Additionally, illustrative purposes and potential income considerations are important factors. Earnings releases and product launches also impact the choice between straddle and strangle options. These considerations help in making informed investment decisions.

How Does Your Risk Tolerance Influence the Choice?

Factors such as stock price movement, time decay, and trading strategies have an impact on your risk tolerance when choosing between straddle and strangle options. Analyzing market conditions and transaction costs is crucial for evaluating risk tolerance in relation to these strategies.

Conclusion

In conclusion, options straddles and strangles are two popular strategies used by investors to take advantage of stock price movements. These options strategies involve buying call and put options to potentially profit from significant price swings in the market.

The main difference between a straddle and a strangle lies in the strike prices. A straddle involves buying call and put options with the same strike price, while a strangle involves buying options with different strike prices. Both strategies provide investors with the opportunity to profit regardless of the direction in which the stock price moves.

Straddles are particularly useful when there is uncertainty about the direction of a stock’s price. By buying both a call and a put option, investors can benefit from significant price moves in either direction. On the other hand, strangles are suitable when investors believe that a stock will move in a specific direction but still want protection against potential downside risks.