Call Spread Options: An In-Depth Guide to Understanding and Using This Trading Strategy

In the world of trading, there are numerous strategies available to investors, each serving a specific purpose. One such strategy is the call spread option. This trading technique involves two call options and is employed when traders anticipate a moderate increase in the price of an underlying asset.

So, what exactly are call spread options? Well, they are a type of options strategy where traders aim to profit from a gradual rise in the price of an asset while also limiting potential losses. This strategy is implemented by purchasing a call option at a specific strike price and simultaneously selling a call option at a higher strike price. It is important to note that both call options should have the same expiration date.

Call spread options offer traders a way to capitalize on market opportunities while managing risk. By limiting potential gains and losses, this strategy can be a cost-effective approach to trading in a volatile market.

Key Takeaways:

- Call spread options involve two call options and are used when anticipating a moderate increase in an asset’s price.

- This strategy aims to profit from a gradual rise in price while limiting potential losses.

- Both call options should have the same expiration date.

- Call spread options offer limited gains and losses, making them cost-effective in volatile markets.

- Traders must carefully consider the risks and benefits before implementing this strategy.

How to Set Up a Call Spread Option

To set up a call spread option, follow these steps:

- Identify the underlying asset you believe will increase in value.

- Buy a call option at a specific strike price that is considered “in the money” if the asset’s price is above the strike price.

- Sell a call option on the same asset with the same expiration date but at a higher strike price, which is considered “out of the money” if the asset’s price is below the strike price.

- Receive a premium from selling the call option, which helps offset the cost of buying the call option and reduces overall investment risk.

By following these steps, you can create a call spread option that allows you to profit from a gradual rise in the price of the underlying asset while limiting potential losses.

Example of Setting Up a Call Spread Option

Let’s consider an example to better understand how to set up a call spread option. Suppose you identify a stock called XYZ, currently trading at $50, and expect a moderate increase in its price over the next month. You decide to set up a call spread option by buying a call option at a strike price of $50 (at-the-money) and selling a call option at a strike price of $55 (out-of-the-money) with the same expiration date. The net premium paid for this trade is $2 per share.

This example demonstrates the basic steps involved in setting up a call spread option and provides a starting point for further exploration of this trading strategy.

Risks and Benefits of Call Spread Options

Call spread options offer traders a range of risks and benefits that are important to consider when setting up this trading strategy. By understanding both the advantages and potential drawbacks, traders can make informed decisions and effectively manage their investments.

Risks

- Limited Profit Potential: One of the main risks of call spread options is that they cap potential profits. While this strategy allows traders to benefit from a moderate increase in an asset’s price, it also forfeits any gains above the strike price of the sold call option. Therefore, if the asset’s price rises significantly, traders may miss out on potential profits.

- Potential Losses: Although call spread options limit losses compared to owning the underlying asset, there is still the risk of losing the net premium paid. If the asset’s price does not rise as anticipated or falls, traders may experience a loss equivalent to the premium.

- Time Decay: Time decay, or the loss of value in options as expiration approaches, can impact call spread options. As the options approach their expiration date, their value decreases, which can have an adverse effect on the overall position.

- Volatility: Market volatility also affects call spread options. Changes in volatility can impact the value of the options, and traders must consider how volatility may impact their positions.

Benefits

- Limited Risk: One of the key benefits of call spread options is the ability to limit potential losses. By selling a call option at a higher strike price, traders can offset some of the costs of buying the call option, reducing the overall risk.

- Cost-Effectiveness: Call spread options can be a cost-effective way to trade in a volatile market. Compared to buying an individual call option, setting up a call spread option requires a lower upfront cost.

- Profit from Moderate Price Movements: Call spread options are designed to profit from a gradual rise in the price of the underlying asset. This strategy allows traders to take advantage of moderate price movements without the need for the asset’s price to increase significantly.

It is important for traders to carefully weigh the risks and benefits of call spread options before implementing this strategy in their trading. By understanding the potential rewards and risks involved, traders can make informed decisions and effectively manage their positions.

Interpreting the payoff diagram of a call spread option provides valuable insights. If the stock price is below the lower strike price, the call spread option expires worthless, resulting in a loss equivalent to the net premium paid. As the stock price rises and reaches the higher strike price, the option reaches its maximum profit. Traders can analyze the breakeven price, maximum gain, and maximum loss from the diagram to make informed trading decisions.

Example:

Let’s consider an example to illustrate the interpretation of a payoff diagram for a call spread option. Suppose we set up a call spread option on stock XYZ, with a lower strike price of $50 and an upper strike price of $60. The net premium paid for this option is $3 per share. The payoff diagram shows that if the stock price is below $50 at expiration, the option expires worthless, resulting in a loss of $3 per share. As the stock price rises and reaches $60 or above, the option reaches its maximum profit of $7 per share. Traders can use this information to determine their risk-reward profile and assess the potential outcomes of the call spread option.

Real-Life Example of a Call Spread Option Payoff

In order to better understand how a call spread option works in practice, let’s examine a real-life example. Suppose we are considering a stock called ABC, currently trading at $50, and we anticipate a moderate increase in its price over the next month. To take advantage of this potential gain while managing our risk, we decide to set up a call spread option.

| Option | Strike Price | Premium |

|---|---|---|

| Buy Call Option | $50 | $3 |

| Sell Call Option | $55 | $1 |

In this example, we buy a call option with a strike price of $50, which is considered “in the money” if the stock price goes above $50. Simultaneously, we sell a call option with a strike price of $55, which is “out of the money” unless the stock price rises significantly. The net premium paid for this trade is $2 per share.

If at expiration the stock price rises to $55 or above, our call option with a strike price of $50 (bought option) will be profitable, while the sold call option with a strike price of $55 will expire worthless. This would result in our maximum profit of $3, which is the difference between the strikes minus the net premium paid. However, if the stock price does not rise significantly or falls, our maximum loss will be limited to the net premium paid, in this case, $2.

Overall, understanding the impact of time decay and volatility is crucial for successfully trading call spread options. Traders should carefully analyze these factors and consider their potential effects on the value and profitability of their options. By remaining vigilant and adaptive to changing market conditions, traders can navigate the complexities of time decay and volatility to make informed trading decisions.

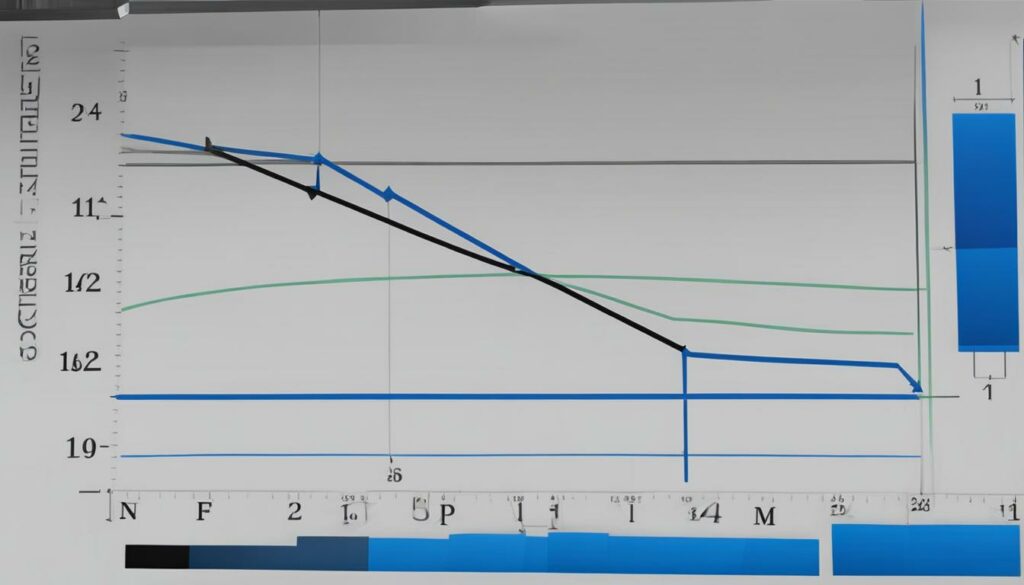

Bull Call Spread vs. Bear Call Spread: Understanding the Difference

When it comes to call spread options, there are two main variations: the bull call spread and the bear call spread. These strategies differ in terms of the price movement that traders anticipate. Let’s take a closer look at the differences between these two types of call spread options and how they differ from other types of options.

Bull Call Spread:

In a bull call spread, traders expect a moderate increase in the price of an underlying asset. This strategy involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price. The goal is to profit from the price of the asset rising, while also limiting potential losses. The lower strike price call option helps offset the cost of the higher strike price call option, reducing the overall investment risk.

Bear Call Spread:

On the other hand, a bear call spread is used when traders anticipate a moderate decrease in the price of an underlying asset. This strategy involves selling a call option at a lower strike price and buying a call option at a higher strike price. The sold call option helps generate premium income, which can offset the cost of the purchased call option. The goal is to profit from the price of the asset falling, while also capping potential losses.

Compared to other types of options, call spread options offer limited potential gains and losses. They provide traders with a cost-effective way to trade in volatile markets and profit from moderate price movements. Unlike a single call option, call spread options help mitigate risk by capping potential losses and reducing the cost of the position through premium income generated from the sold option.

| Key Differences | Bull Call Spread | Bear Call Spread |

|---|---|---|

| Price Movement | Expect moderate increase | Expect moderate decrease |

| Strategy | Buy low strike price call option and sell high strike price call option | Sell low strike price call option and buy high strike price call option |

| Potential Gains | Limited | Limited |

| Potential Losses | Limited | Limited |

Understanding the difference between a bull call spread and a bear call spread is essential for traders looking to incorporate these strategies into their trading toolbox. By accurately predicting price movements and selecting the appropriate strategy, traders can minimize risks and maximize potential gains. It is important to conduct thorough analysis and evaluate market conditions before implementing any options strategy.

Determining the Best Strike Prices for a Call Spread Option

When setting up a call spread option, one crucial consideration is determining the best strike prices. The choice of strike prices will depend on various factors, including your outlook for the underlying asset, desired risk-reward profile, and current market conditions. To make an informed decision, it’s essential to take into account several key factors.

Support and Resistance Levels

Support and resistance levels are significant price levels that can help determine the best strike prices for a call spread option. Support levels indicate the price at which the asset has historically found buying interest and potentially reversed its downtrend. Resistance levels, on the other hand, represent the price at which the asset has historically encountered selling pressure and potentially reversed its uptrend. Identifying these levels can assist in selecting strike prices that align with potential price movements.

Technical Analysis Indicators

Technical analysis indicators can provide valuable insights into market trends and price patterns. Traders commonly use indicators such as moving averages, relative strength index (RSI), and stochastic oscillators to assess the direction and momentum of an asset’s price. By analyzing these indicators, traders can gain a better understanding of potential price movements and identify strike prices that align with their trading strategy.

Cost of Options and Potential Payoff

When determining the best strike prices, it’s crucial to consider the cost of options and the potential payoff. Higher strike prices generally provide a lower cost for the call spread option, but they also limit the potential profit. Conversely, lower strike prices may increase the cost of the option but offer a higher profit potential. Traders should find a balance between affordability and potential profit based on their risk appetite and trading objectives.

| Strike Prices | Cost of Options | Potential Payoff |

|---|---|---|

| Higher | Lower | Limited |

| Lower | Higher | Higher |

Remember that the choice of strike prices for a call spread option is highly subjective and may vary depending on individual trading strategies and market conditions. It’s important to conduct thorough research, analyze the current market environment, and consider these factors before finalizing your strike prices.

Conclusion

In conclusion, call spread options can be a valuable tool in our trading strategy, providing a cost-effective way to profit from moderate price movements in an asset. By understanding the strategy, setting up the option correctly, and managing the associated risks, we can optimize our trades.

It is important to continually assess market conditions and determine the best time to use a call spread option in our trading strategy. This involves conducting thorough research and analysis, considering factors such as the underlying asset’s outlook, desired risk-reward profile, and current market conditions.

Each trade carries its own risks and rewards, so it is crucial to make informed decisions based on our individual trading goals and risk tolerance. As with any options strategy, the key to success lies in careful planning, continuous monitoring, and adapting our approach as market conditions change.

By employing call spread options strategically and in accordance with our trading plan, we can enhance our trading performance and potentially achieve our desired financial outcomes. Remember, determining the best time to use a call spread option requires a thorough understanding of the market and disciplined decision-making.

FAQ

What is a call spread option?

A call spread option is a popular trading strategy that involves buying a call option at a specific strike price and selling a call option at a higher strike price. Traders use this strategy when they anticipate a moderate increase in the price of an underlying asset.

How do I set up a call spread option?

To set up a call spread option, you need to identify the underlying asset, buy a call option at a specific strike price that is “in the money,” and sell a call option at a higher strike price that is “out of the money.” Both options should have the same expiration date.

What are the risks and benefits of call spread options?

The benefits of call spread options include the potential for limited gains, lower cost compared to buying individual options, and the ability to limit losses. However, this strategy also caps potential profits and may result in a loss equivalent to the net premium paid.

How do I interpret the payoff diagram of a call spread option?

The payoff diagram shows the profit or loss at expiration for different stock prices. It consists of a range between the lower strike price and upper strike price. If the stock price is below the lower strike price, the option expires worthless. As the stock price rises and reaches the higher strike price, the option reaches its maximum profit.

Can you provide an example of a call spread option payoff?

Sure! Suppose you set up a call spread option on a stock called ABC. You buy a call option at a strike price of $50 and sell a call option at a strike price of $55, both with the same expiration date. If the stock price rises to $55 or above at expiration, you achieve the maximum profit. However, if the stock price does not rise significantly or falls, you incur a loss limited to the net premium paid.

How does time decay and volatility impact call spread options?

Time decay, or theta, negatively affects the long call option in a call spread, as its value decreases with less time remaining. Volatility can impact call spread options, as changes in volatility tend to affect the price of options. However, the effects of volatility on a call spread option can be offset to some extent due to the long and short positions involved.

What is the difference between a bull call spread and a bear call spread?

A bull call spread is used when a trader expects a moderate increase in an asset’s price, while a bear call spread is used when a trader expects a moderate decrease. The main difference is the direction of the anticipated price movement.

How do I determine the best strike prices for a call spread option?

The choice of strike prices depends on your outlook for the underlying asset, the desired risk-reward profile, and market conditions. Factors to consider include the current price of the asset, support and resistance levels, and technical analysis indicators.

What should I consider when using a call spread option in my trading strategy?

It is important to continually assess market conditions and determine the best time to use a call spread option. Each trade carries its own risks and rewards, so conducting thorough research and analysis is crucial before implementing any options strategy.