What Are Options Quotes?

Options quotes provide valuable information about the price, expiration date, and strike price of options contracts. They consist of calls and puts, where a call option gives the right to buy a stock and a put option gives the right to sell a stock. The premium is the price of the options contract, and it fluctuates based on the underlying stock’s price. Options quotes can be found on financial websites such as Yahoo Finance and online trading sites like Charles Schwab and TD Ameritrade.

Key Takeaways:

- Options quotes provide crucial information about options contracts.

- They include details such as price, expiration date, and strike price.

- Options quotes consist of calls and puts.

- Premiums fluctuate based on the stock’s price.

- Financial websites and online trading sites provide options quotes.

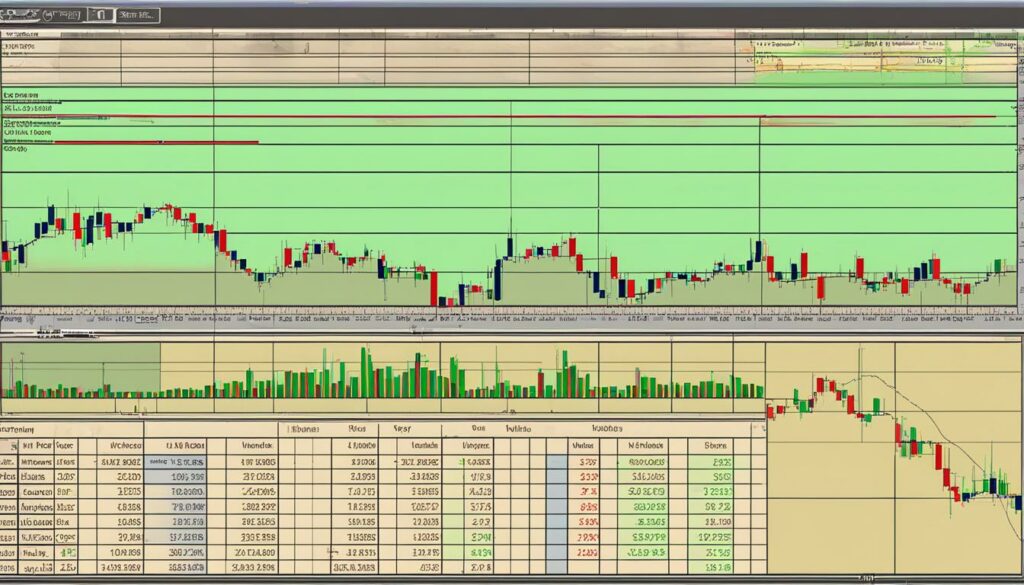

Understanding Options Chain Charts

Options chain charts are a valuable tool for investors to analyze and understand options contracts for a specific security. These charts provide detailed information about various options, including the strike price, premium, expiration date, and other relevant details.

When looking at an options chain chart, you will notice that calls and puts are listed separately. Generally, the calls section appears first. The strike price, also known as the exercise price, is the price at which the underlying stock can be bought or sold if the option is exercised. The premium represents the price of the options contract and can fluctuate based on the price movements of the underlying stock.

Each options contract has a unique symbol and expiration date, which impact its premium. It’s important to understand that different strike prices and expiration dates will result in different premium values. By analyzing the options chain chart, investors can gain insights into the available options contracts for a security and make informed decisions based on their investment strategies.

Example Options Chain Chart

| Strike Price | Expiration Date | Call Premium | Put Premium |

|---|---|---|---|

| 100 | 30th June 2022 | 5.00 | 2.50 |

| 110 | 30th June 2022 | 3.50 | 1.80 |

| 120 | 30th June 2022 | 2.00 | 1.00 |

In the example options chain chart above, we can see different strike prices and expiration dates along with their corresponding call and put premiums. This information can help investors assess the potential costs and benefits of different options contracts and build option strategies accordingly.

Understanding options chain charts is essential for anyone interested in options trading. By analyzing these charts, investors can identify attractive options contracts and make informed decisions based on their trading strategies and market conditions.

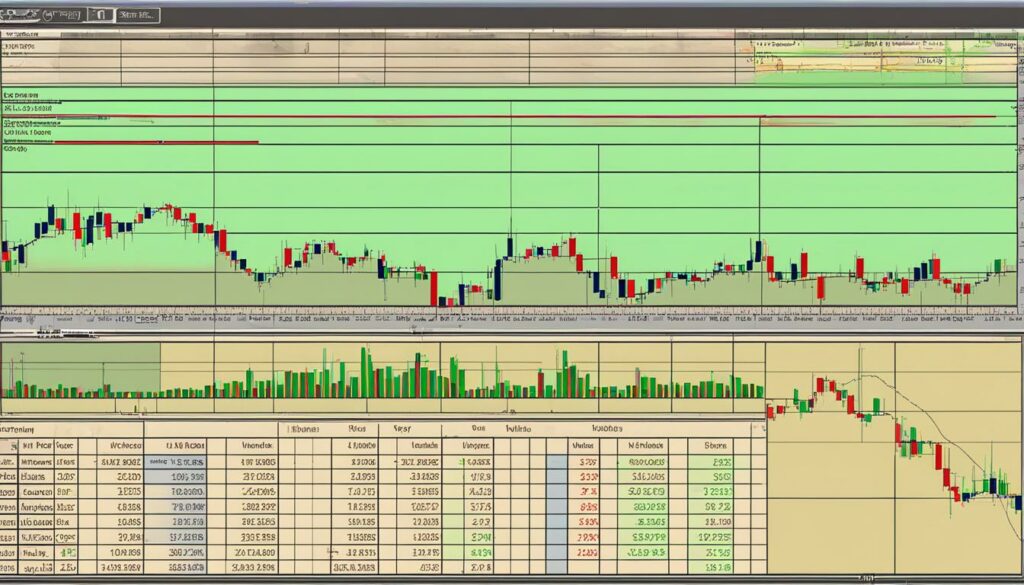

How to Interpret Options Quotes

Interpreting options quotes is crucial for investors looking to engage in options trading. Options quotes provide essential information about the price, expiration date, strike price, and other details of options contracts. By understanding the various components of an options quote, investors can make informed decisions and potentially maximize their investment returns in the options market.

When analyzing options quotes, it is important to consider key terms such as bid price, ask price, volume, and open interest. The bid price represents the price at which buyers are willing to purchase the options contract, while the ask price represents the price at which sellers are willing to sell. The volume column indicates the number of options contracts traded in a particular day, providing insights into the level of trading activity. Open interest, on the other hand, reveals the number of outstanding options contracts, indicating the overall interest and liquidity of a specific option.

The premium is another crucial aspect of options quotes. It represents the price of the options contract and fluctuates based on factors such as the underlying stock’s price, time remaining until expiry, and market volatility. Higher premiums generally indicate higher potential profitability, but they also come with increased risk. Analyzing premiums can help investors assess the potential rewards and risks associated with specific options contracts.

| Term | Definition |

|---|---|

| Bid Price | The price at which buyers are willing to purchase the options contract. |

| Ask Price | The price at which sellers are willing to sell the options contract. |

| Volume | The number of options contracts traded in a particular day. |

| Open Interest | The number of outstanding options contracts. |

| Premium | The price of the options contract. |

“Options quotes provide important insights into market sentiment and can assist investors in making informed decisions based on the supply and demand dynamics of options contracts.” – Options Trading Expert

Overall, understanding how to interpret options quotes is vital for navigating the options market successfully. By analyzing bid and ask prices, volume, open interest, and premiums, investors can gain valuable insights into market sentiment and make informed decisions when trading options.

Factors Affecting Options Premiums

When trading options, understanding the factors that affect options premiums is crucial. These factors play a significant role in determining the price of options contracts and can greatly impact an investor’s potential profitability. Here are the key factors to consider:

- Time Remaining Until Expiry: Options contracts closer to their expiration date tend to lose value quickly. As the expiration date approaches, the time value of the option diminishes, resulting in a decrease in its premium.

- Strike Price: The strike price is the price at which the underlying stock can be bought or sold if the option is exercised. For call options, higher strike prices generally result in lower premiums. Conversely, for put options, lower strike prices tend to have lower premiums.

- Stock Volatility: Volatility refers to the magnitude of price fluctuations in the underlying stock. Higher volatility leads to higher premiums as it increases the likelihood of the option’s value changing significantly before expiration.

- Underlying Stock Price and Market Conditions: The price of the underlying stock and the overall market conditions can also impact options premiums. If the stock price experiences significant fluctuations or if market conditions are uncertain, options premiums may be higher.

By considering these factors, investors can make informed decisions when trading options. It is essential to evaluate options quotes and analyze the potential impact of each factor on the premiums. This analysis can help investors identify opportunities and manage risk effectively.

It’s important to note that options pricing is complex, and multiple factors interact to determine the premium. Online brokers and financial websites provide options quotes that reflect these factors, allowing investors to make informed decisions based on the most up-to-date information.

Example Options Premiums table:

| Option Type | Expiration Date | Strike Price | Bid Price | Ask Price | Volume | Open Interest |

|---|---|---|---|---|---|---|

| Call | April 30, 2023 | $100 | $2.50 | $2.70 | 500 | 1,000 |

| Put | April 30, 2023 | $100 | $2.00 | $2.20 | 300 | 800 |

This table displays options premiums for call and put options with the same expiration date and strike price. The bid price represents the price at which buyers are willing to purchase the options contract, while the ask price indicates the price at which sellers are willing to sell. Volume represents the number of options contracts traded in a particular day, and open interest refers to the number of outstanding options contracts. This information can provide insights into the demand and liquidity of specific options contracts, helping investors gauge market sentiment.

By understanding and analyzing the factors affecting options premiums and utilizing the available options quotes, investors can navigate the options market more effectively and potentially increase their chances of success.

Importance of Open Interest and Volume

When analyzing options quotes, open interest and volume are two key metrics that provide valuable insights for investors. Open interest refers to the total number of outstanding options contracts for a particular security, while volume represents the number of options contracts traded in a given day. Both metrics play a crucial role in understanding the liquidity and market sentiment surrounding options contracts.

High open interest indicates that there is significant interest in a particular options contract, suggesting higher liquidity and easier entry and exit from positions. It reflects the level of demand for a specific contract but does not provide information about the direction of the stock’s movement. Therefore, it is important not to solely rely on open interest when predicting stock price movements.

Volume, on the other hand, provides a real-time measure of the level of trading activity in options contracts. Higher volume suggests greater investor interest and participation in the market. It can indicate market trends and potential price movements. Monitoring volume can help investors gauge the level of market participation and make informed trading decisions.

By considering both open interest and volume in conjunction with other factors such as options quotes, investors can gain a more comprehensive understanding of market dynamics and sentiment. These metrics serve as valuable indicators that can assist investors in analyzing options contracts and making well-informed trading decisions.

“Open interest and volume are essential metrics for options traders. They provide insights into market liquidity and investor sentiment, enabling traders to assess the level of interest and trading activity in options contracts. By monitoring these metrics, traders can identify potential opportunities and make informed trading decisions.”

Understanding In-the-Money and Out-of-the-Money Options

When analyzing options quotes, it is essential to understand the concepts of in-the-money and out-of-the-money options. These terms describe the relationship between the strike price of an option and the current market price of the underlying stock. In-the-money options are options that have strike prices that have already crossed the stock’s current market price. This indicates that they have intrinsic value. For example, a call option with a strike price below the stock’s current market price is considered in-the-money, as it allows the holder to buy the stock at a lower price than the market value.

On the other hand, out-of-the-money options have strike prices that have not crossed the stock’s current market price. This means that they do not have intrinsic value and rely solely on the stock’s price moving in the desired direction before expiration to become profitable. For instance, a call option with a strike price above the stock’s current market price is considered out-of-the-money. In this case, the stock needs to increase in value for the option to be profitable.

Understanding whether an option is in-the-money or out-of-the-money is crucial for investors in making informed investment decisions. In-the-money options generally have higher premiums compared to out-of-the-money options since they have intrinsic value. This is because they provide the holder with an immediate advantage in being able to buy or sell the stock at a favorable price. On the other hand, out-of-the-money options have lower premiums as they rely on the stock’s future performance for profitability.

By analyzing options quotes and identifying whether an option is in-the-money or out-of-the-money, investors can assess the potential profitability and risk associated with different options contracts. This understanding allows for more informed decision-making when it comes to options trading strategies.

Table: Comparison of In-the-Money and Out-of-the-Money Options

| In-the-Money Options | Out-of-the-Money Options | |

|---|---|---|

| Definition | Options with strike prices that have crossed the stock’s current market price. | Options with strike prices that have not crossed the stock’s current market price. |

| Intrinsic Value | Have intrinsic value due to the favorable difference between the strike price and current market price. | Do not have intrinsic value and rely on the stock’s future performance for profitability. |

| Premiums | Generally have higher premiums compared to out-of-the-money options. | Generally have lower premiums compared to in-the-money options. |

| Risk and Profitability | Provide an immediate advantage in being able to buy or sell the stock at a favorable price. | Rely on the stock’s future performance for profitability. |

Using Options Calculator for Analysis

An options calculator is a valuable tool for investors looking to analyze options quotes and make informed investment decisions. This tool provides essential information such as fair values and Greeks for any option, allowing investors to customize input parameters to suit their needs. With an options calculator, investors can input factors such as option style, underlying stock price, strike price, and implied volatility to determine potential profitability and assess risk.

By utilizing an options calculator, investors can gain insights into the potential outcomes of their options trades. They can evaluate the impact of different factors on the options premiums and make better-informed decisions. For example, investors can analyze how changes in the stock price or volatility affect the option’s value. They can also compare different strike prices and expiration dates to identify the most favorable options contracts.

“The options calculator allows investors to analyze different scenarios and understand the potential risks and rewards of their options trades.” – John Smith, Options Trading Expert

Additionally, options calculators can help investors develop and test various option strategies. They can assess the potential profitability of complex strategies such as straddles, strangles, or iron condors. By inputting the necessary parameters into the calculator, investors can evaluate the potential profit and loss of these strategies under different market conditions.

Example:

To illustrate the effectiveness of an options calculator, consider the following scenario. An investor is considering purchasing a call option on XYZ stock with a strike price of $100. The current market price of the stock is $90, and the option has an expiration date of one month. By using an options calculator, the investor can input these parameters along with the expected volatility of the stock to assess the potential profit and risk of the investment.

| Stock Price | Option Premium | Potential Profit | Potential Loss |

|---|---|---|---|

| $90 | $5 | $500 | $0 |

| $95 | $8 | $800 | $0 |

| $100 | $12 | $1,200 | $0 |

| $105 | $15 | $1,500 | $0 |

In this example, the options calculator shows that if the stock price reaches $100 or higher at expiration, the investor could potentially earn a profit of $1,200 or more, depending on the actual premium at that time. If the stock price remains below $100, the investor would lose the premium paid for the option ($0 potential loss). This analysis allows the investor to evaluate the risk-reward profile of the options trade and make an informed decision.

Using an options calculator can provide investors with valuable insights into the potential profitability and risk of options trades. By considering various factors and scenarios, investors can make informed decisions, increase their chances of success, and ultimately maximize their investment returns in the options market.

Conclusion

Understanding options quotes is essential for those interested in options trading. Options quotes provide valuable information about the price, expiration date, strike price, and other details of options contracts. By analyzing options quotes and using tools like options calculators, investors can make informed decisions and potentially maximize their investment returns in the options market.

FAQ

What Are Options Quotes?

Options quotes provide valuable information about the price, expiration date, and strike price of options contracts. They consist of calls and puts, where a call option gives the right to buy a stock and a put option gives the right to sell a stock. The premium is the price of the options contract, and it fluctuates based on the underlying stock’s price. Options quotes can be found on financial websites such as Yahoo Finance and online trading sites like Charles Schwab and TD Ameritrade.

Understanding Options Chain Charts

Options chain charts display the information about options contracts for a particular security. They show the strike price, premium, expiration date, and other details. Calls and puts are listed separately, with the calls section usually appearing first. The strike price is the price at which the stock can be bought or sold if the option is exercised. The premium is the price of the options contract, and it fluctuates based on the stock’s price movements. Different options contracts have different symbols and expiry dates, which impact their premiums.

How to Interpret Options Quotes

Options quotes provide important information for investors. The bid price is the price at which buyers are willing to purchase the options contract, while the ask price is the price at which sellers are willing to sell. The volume column shows the number of options contracts traded in a particular day, and the open interest column shows the number of outstanding options contracts. The price of the options contract is called the premium, and it fluctuates based on factors like the stock’s price, time remaining until expiry, and volatility. Higher premiums indicate higher potential profitability.

Factors Affecting Options Premiums

Several factors impact the price of options premiums. The time remaining until expiry is one of the key factors, with options contracts closer to expiry losing value quickly. The strike price also affects the premium, with higher strike prices for call options generally resulting in lower premiums, and lower strike prices for put options resulting in lower premiums. The stock’s volatility also plays a role, with higher volatility leading to higher premiums. Additionally, the price of the underlying stock and the current market conditions can affect options premiums.

Importance of Open Interest and Volume

Open interest and volume are important indicators in options quotes. Open interest refers to the number of outstanding options contracts, while volume represents the number of options traded in a particular day. High open interest indicates that there is significant interest in a particular options contract, implying liquidity. This is important for investors as it allows for easy entry and exit from positions. However, high open interest does not necessarily indicate the direction of the stock’s movement. It shows the level of demand for a particular options contract, but investors should not solely rely on it to predict stock price movements.

Understanding In-the-Money and Out-of-the-Money Options

In-the-money options have strike prices that have already crossed the stock’s current market price, indicating that they have intrinsic value. Out-of-the-money options have strike prices that have not crossed the stock’s current market price, indicating that they do not yet have intrinsic value. These options rely on the stock’s price moving in the desired direction before expiry to become profitable. Understanding whether an option is in-the-money or out-of-the-money is crucial for investors in making informed investment decisions.

Using Options Calculator for Analysis

An options calculator can be a useful tool for investors to analyze options quotes. It provides fair values and Greeks of any option, allowing investors to customize input parameters such as option style, underlying stock price, strike price, implied volatility, and more. The options calculator can help investors determine potential profitability and assess risk. It is important to use accurate and reliable data when using an options calculator for analysis.